正版 彼得林奇的成功投资 英文原版 One Up On Wall Street 全英文版股票理财经典书籍 Peter Lynch彼得林奇的选股战略 进口英语书

| 运费: | ¥ 0.00-999.00 |

| 库存: | 63 件 |

商品详情

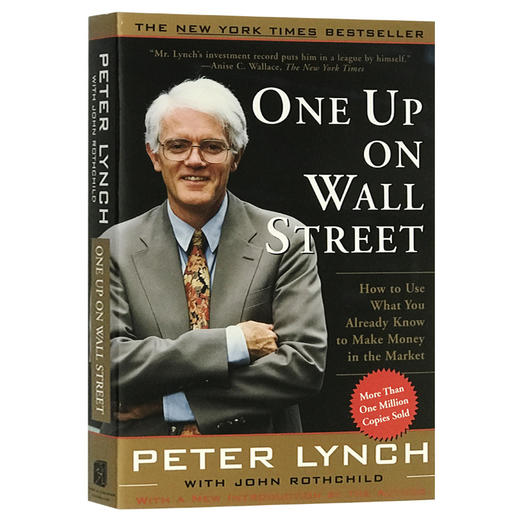

书名:One Up On Wall Street: How To Use What You Already Know To Make Money In The Market 彼得林奇的成功投资

作者:Peter Lynch

出版社名称:Simon & Schuster

出版时间:2000

语种:英文

ISBN:9780743200400

商品尺寸:14 x 2.5 x 21.4 cm

包装:平装

页数:304

One Up On Wall Street《彼得林奇的成功投资》是深受普通投资者欢迎与推崇的投资经典之一。出版至今,销量高达百万册,畅销全球。作者用浅显生动的语言娓娓道出了股票投资的诸多技巧,向广大的中小投资者提供了简单易学的投资分析方法,这些方法是作者多年的经验总结,具有很强的实践性,对于业余投资者来说尤为有益。

推荐理由:

1.华尔街传奇股神彼得林奇经典佳作,股票投资者必读书;

2. 销量超过百万的畅销书,普通投资者的投资经典;

3. 英文原版,内容原汁原味,阅读难度不大。

THE NATIONAL BESTSELLING BOOK THAT EVERY INVESTOR SHOULD OWN

Peter Lynch is America’s number-one money manager. His mantra: Average investors can become experts in their own field and can pick winning stocks as effectively as Wall Street professionals by doing just a little research.

Now, in a new introduction written specifically for this edition ofOne Up on Wall Street, Lynch gives his take on the incredible rise of Internet stocks, as well as a list of twenty winning companies of high-tech ’90s. That many of these winners are low-tech supports his thesis that amateur investors can continue to reap exceptional rewards from mundane, easy-to-understand companies they encounter in their daily lives.

Investment opportunities abound for the layperson, Lynch says. By simply observing business developments and taking notice of your immediate world — from the mall to the workplace — you can discover potentially successful companies before professional analysts do. This jump on the experts is what produces “tenbaggers,” the stocks that appreciate tenfold or more and turn an average stock portfolio into a star performer.

The former star manager of Fidelity’s multibillion-dollar Magellan Fund, Lynch reveals how he achieved his spectacular record. Writing with John Rothchild, Lynch offers easy-to-follow directions for sorting out the long shots from the no shots by reviewing a company’s financial statements and by identifying which numbers really count. He explains how to stalk tenbaggers and lays out the guidelines for investing in cyclical, turnaround, and fast-growing companies.

Lynch promises that if you ignore the ups and downs of the market and the endless speculation about interest rates, in the long term (anywhere from five to fifteen years) your portfolio will reward you. This advice has proved to be timeless and has madeOne Up on Wall Street a number-one bestseller. And now this classic is as valuable in the new millennium as ever.

One Up On Wall Street《彼得林奇的成功投资》系统介绍如何做好股票投资的充分准备,如何从生活和工作中开始寻找你喜爱的上市公司股票,如何分析上市公司的业务、财务、股票等基本面情况以及如何正确认识股价的波动,在股票投资中想要知道的问题,几乎都可以在《彼得林奇的成功投资》中找到答案。

只要用心对股票做一点点研究,普通投资者也能成为股票投资专家,并且在选股方面的成绩能像华尔街的专家一样出色。

对于外行人来说,投资机会随处可见。只要仔细观察一下商业的发展趋势,留心一下周围的世界,从购物中心到自己工作的地方,你就可以比专业分析人员更早地发现那些潜在的将会大获成功的公司。

如果投资者能够不被整个市场行情的波动以及利率的变动影响,那么进行长期投资的投资组合一定会给其带来不菲的回报。

Peter Lynch believes that average investors have advantages over Wall Street experts. Since the best opportunities can be found at the local mall or in their own places of employment, beginners have the chance to learn about potentially successful companies long before before professional analysts discover them. This headstart on the experts is what produces ‘tenbaggers’, the stocks that appreciate tenfold or more and turn an average stock portfolio into a star performer. In this fully updated edition of his classic bestseller, Lynch explains how to research stocks and offers easy-to-follow directions for sorting out the long shots from the no shots. He also provides valuable advice on how to learn as much as possible from a company’s story, and why every investor must ignore the ups and downs of the stock market and focus only on the fundamentals of the company in which they are investing.

彼得·林奇,是美国乃至全球首屈一指的投资专家。他对投资基金的贡献,就像乔丹对篮球的贡献,他把基金管理提升到一个新的境界,将选股变成了一门艺术。

彼得·林奇生于1944年,15岁开始小试投资,赚取学费,1968年毕业于宾夕法尼亚大学沃顿商学院,取得MBA学位。约翰·罗瑟查尔德与彼得·林奇合作出版过《战胜华尔街》在《时代》《财富》《价值》等刊物上均发表过文章。

Peter Lynch managed the Fidelity Magellan Fund from 1977 to 1990 when it was one of the most successful mutual-funds of all time. He then became a vice chairman at Fidelity and more recently has become a prominent philanthropist particularly active in the Boston area. His books include One Up on Wall Street, Beating the Street, and Learn to Earn (all written with John Rothchild).

Introduction to the Millennium Edition 千禧版序言

PROLOGUE: A Note from Ireland 前言爱尔兰之行的启示

INTRODUCTION: The Advantages of Dumb Money 导论业余投资者的优势

PARTⅠ Preparing to Invest 第一部分投资准备

The Making of a Stockpicker我是如何成长为一个选股者的

The Wall Street Oxymorons 专业投资者的劣势

Is This Gambling, or What?股票投资是赌博吗

Passing the Mirror Test进入股市前的自我测试

Is This a Good Market? Please Don’t Ask 不要预测股市

PARTⅡPicking Winners 第二部分挑选大牛股

Stalking the Tenbagger 寻找10倍股

I’ve Got It, I’ve Got It—What Is It? 6种类型公司股票

The Perfect Stock, What a Deal! 13条选股准则

Stocks I’d Avoid 我避而不买的股票

Earnings, Earnings, Earnings 收益,收益,还是收益

The Two-Minute Drill 下单之前沉思两分钟

Getting the Facts 如何获得真实的公司信息

Some Famous Numbers 一些重要的财务分析指标

Rechecking the Storv 定期重新核查公司分析

The Final Checklist 股票分析要点一览表

PARTⅢ The Long-term View 第三部分长期投资

Designing a Portfolio 构建投资组合

The Best Time to Buy and Sell 买入和卖出的zui佳时机选择

The Twelve Silliest (and Most Dangerous) Things People Say About Stock Prices12种关于股价的zui愚蠢且zui危险的说法

Options, Futures, and Shorts 期权、期货与卖空交易

50,000 Frenchmen Can Be Wrong 5万个专业投资者也许都是错的

EPILOGUE: Caught with My Pants Up 后记 马里兰之旅的感悟

ACKNOWLEDGMENTS 致谢

INDEX 索引

Introduction to the Millennium Edition

This book was written to offer encouragement and basic information to the individual investor. Who knew it would go through thirty printings and sell more than one million copies? As this latest edition appears eleven years beyond the first, I’m convinced that the same principles that helped me perform well at the Fidelity Magellan Fund still apply to investing in stocks today.

It’s been a remarkable stretch sinceOne Up on Wall Street hit the bookstores in 1989. I left Magellan in May, 1990, and pundits said it was a brilliant move. They congratulated me for getting out at the right time — just before the collapse of the great bull market. For the moment, the pessimists looked smart. The country’s major banks flirted with insolvency, and a few went belly up. By early fall, war was brewing in Iraq. Stocks suffered one of their worst declines in recent memory. But then the war was won, the banking system survived, and stocks rebounded.

Some rebound! The Dow is up more than fourfold since October, 1990, from the 2,400 level to 11,000 and beyond — the best decade for stocks in the twentieth century. Nearly 50 percent of U.S. households own stocks or mutual funds, up from 32 percent in 1989. The market at large has created $25 trillion in new wealth, which is on display in every city and town. If this keeps up, somebody will write a book called The Billionaire Next Door.

More than $4 trillion of that new wealth is invested in mutual funds, up from $275 billion in 1989. The fund bonanza is okay by me, since I managed a fund. But it also must mean a lot of amateur stockpickers did poorly with their picks. If they’d done better on their own in this mother of all bull markets, they wouldn’t have migrated to funds to the extent they have. Perhaps the information contained in this book will set some errant stockpickers on a more profitable path.

Since stepping down at Magellan, I’ve become an individual investor myself. On the charitable front, I raise scholarship money to send inner-city kids of all faiths to Boston Catholic schools. Otherwise, I work part-time at Fidelity as a fund trustee and as an adviser/trainer for young research analysts. Lately my leisure time is up at least thirtyfold, as I spend more time with my family at home and abroad.

Enough about me. Let’s get back to my favorite subject: stocks. From the start of this bull market in August 1982, we’ve seen the greatest advance in stock prices in U.S. history, with the Dow up fifteenfold. In Lynch lingo that’s a “fifteenbagger.” I’m accustomed to finding fifteenbaggers in a variety of successful companies, but a fifteenbagger in the market at large is a stunning reward. Consider this: From the top in 1929 through 1982, the Dow produced only a fourbagger: up from 248 to 1,046 in a half century! Lately stock prices have risen faster as they’ve moved higher. It took the Dow 8 1/3 years to double from 2,500 to 5,000, and only 3 1/2 years to double from 5,000 to 10,000. From 1995-99 we saw an unprecedented five straight years where stocks returned 20 percent plus. Never before has the market recorded more than two back-to-back 20 percent gains.

Wall Street’s greatest bull market has rewarded the believers and confounded the skeptics to a degree neither side could have imagined in the doldrums of the early 1970s, when I first took the helm at Magellan. At that low point, demoralized investors had to remind themselves that bear markets don’t last forever, and those with patience held on to their stocks and mutual funds for the fifteen years it took the Dow and other averages to regain the prices reached in the mid-1960s. Today it’s worth reminding ourselves that bull markets don’t last forever and that patience is required in both directions.

On page 280 of this book I say the breakup of ATT in 1984 may have been the most significant stock market development of that era. Today it’s the Internet, and so far the Internet has passed me by. All along I’ve been technophobic. My experience shows you don’t have to be trendy to succeed as an investor. In fact, most great investors I know (Warren Buffett, for starters) are technophobes. They don’t own what they don’t understand, and neither do I. I understand Dunkin’ Donuts and Chrysler, which is why both inhabited my portfolio, I understand banks, savings-and-loans, and their close relative, Fannie Mae. I don’t visit the Web. I’ve never surfed on it or chatted across it. Without expert help (from my wife or my children, for instance) I couldn’t find the Web.

- 华研外语 (微信公众号认证)

- 本店是“华研外语”品牌商自营店,全国所有“华研外语”、“华研教育”品牌图书都是我司出版发行的,本店为华研官方源头出货,所有图书均为正规正版,拥有实惠与正版的保障!!!

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...