商品详情

Asset Pricing

基本信息

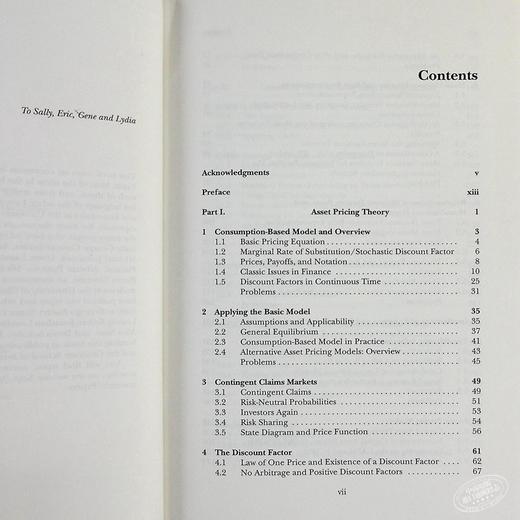

Format:Hardback 560 pages, 51 line illus. 20 tables.

Publisher:Princeton University Press

Imprint:Princeton University Press

ISBN:9780691121376

Published:3 Jan 2005

Classifications:Investment & securities

Weight:922g

Dimensions:243 x 165 x 39 (mm)

Pub. Country:United States

页面参数仅供参考,具体以实物为准

书籍简介

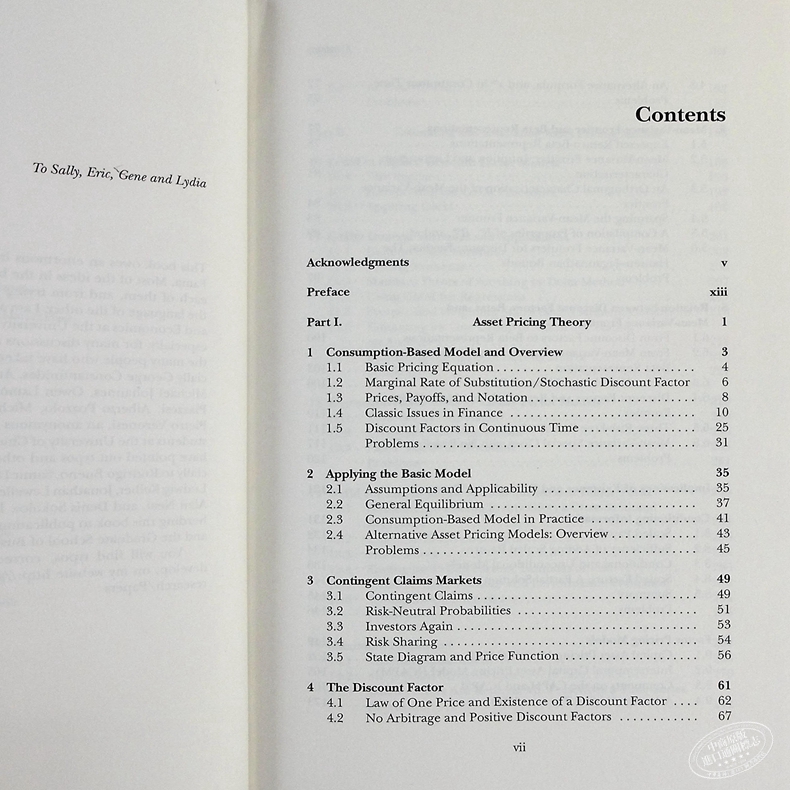

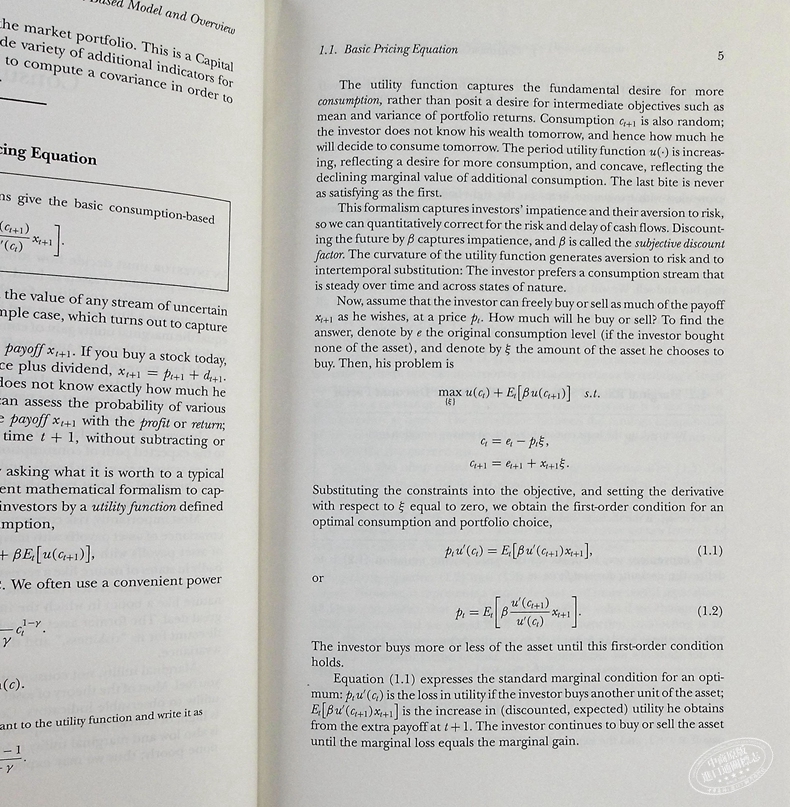

Winner of the prestigious Paul A. Samuelson Award for scholarly writing on lifelong financial security, John Cochrane's Asset Pricing now appears in a revised edition that unifies and brings the science of asset pricing up to date for advanced students and professionals. Cochrane traces the pricing of all assets back to a single idea--price equals expected discounted payoff--that captures the macro-economic risks underlying each security's value.

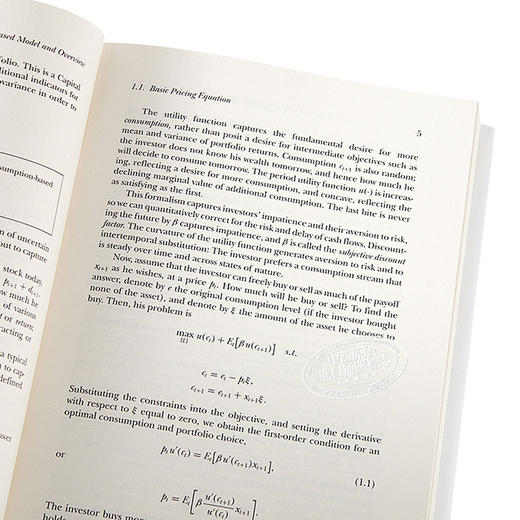

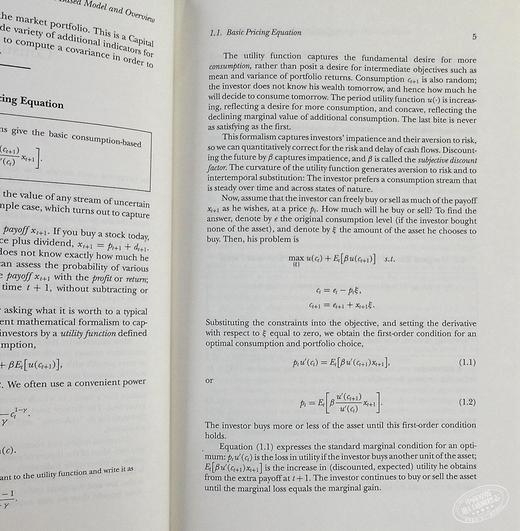

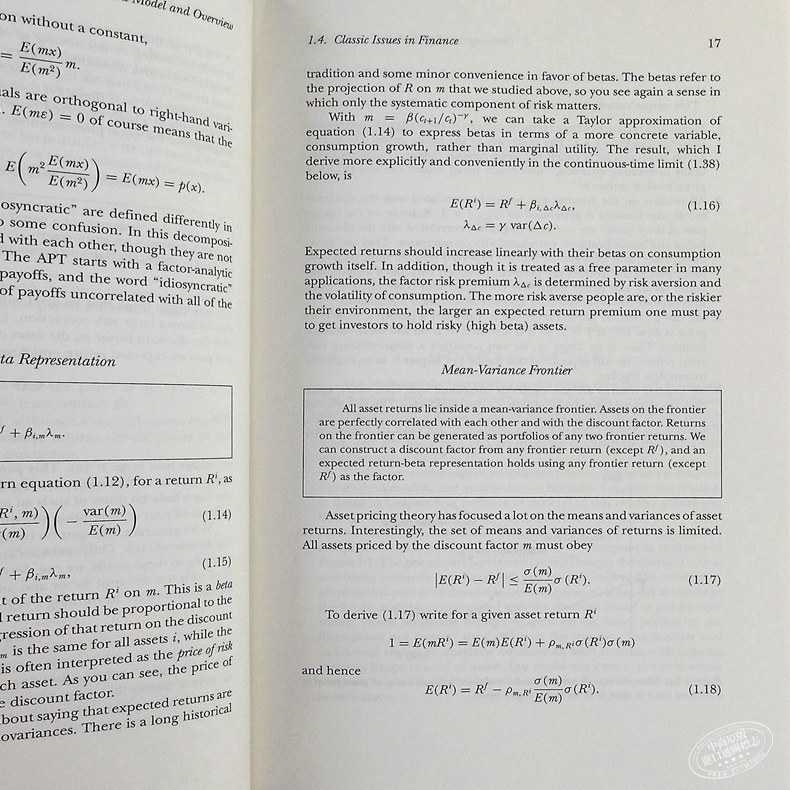

By using a single, stochastic discount factor rather than a separate set of tricks for each asset class, Cochrane builds a unified account of modern asset pricing. He presents applications to stocks, bonds, and options. Each model--consumption based, CAPM, multifactor, term structure, and option pricing--is derived as a different specification of the discounted factor.

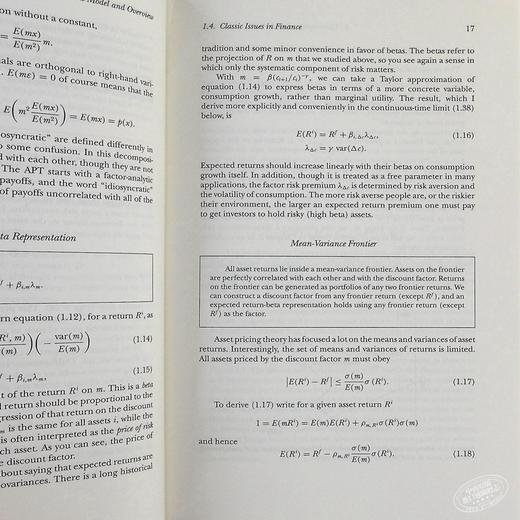

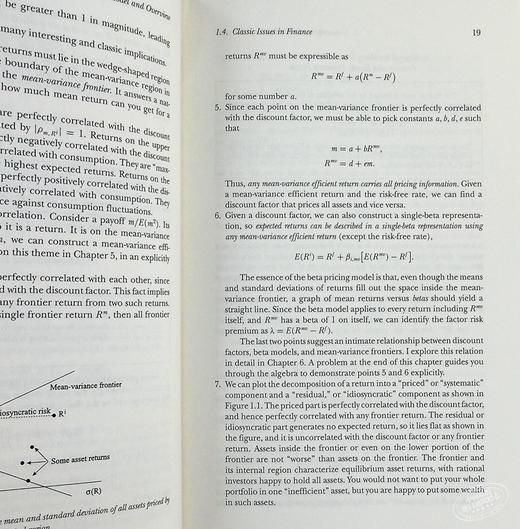

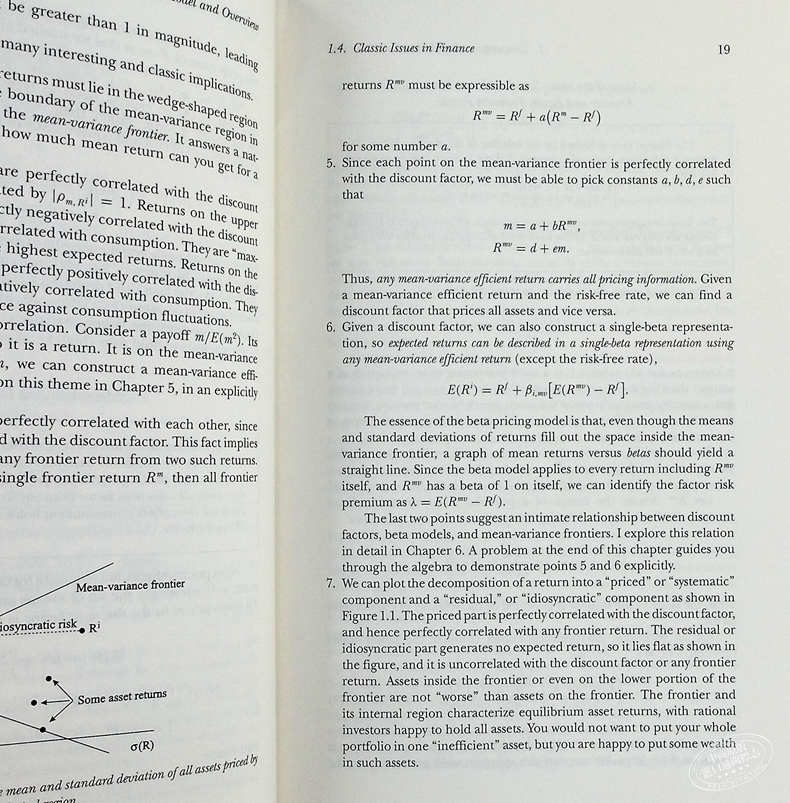

The discount factor framework also leads to a state-space geometry for mean-variance frontiers and asset pricing models. It puts payoffs in different states of nature on the axes rather than mean and variance of return, leading to a new and conveniently linear geometrical representation of asset pricing ideas. Cochrane approaches empirical work with the Generalized Method of Moments, which studies sample average prices and discounted payoffs to determine whether price does equal expected discounted payoff.

He translates between the discount factor, GMM, and state-space language and the beta, mean-variance, and regression language common in empirical work and earlier theory. The book also includes a review of recent empirical work on return predictability, value and other puzzles in the cross section, and equity premium puzzles and their resolution. Written to be a summary for academics and professionals as well as a textbook, this book condenses and advances recent scholarship in financial economics.

作为享有盛誉的保罗·萨缪尔森终身金融安全学术著作奖的获得者,约翰·科克伦的《资产定价》现在出现在修订版中,该修订版将资产定价的科学与先进的学生和专业人士相结合,并使之与时俱进。科克伦将所有资产的定价追溯到一个单一的概念——价格等于预期折现收益——这捕捉了每种证券价值背后的宏观经济风险。

通过使用一个随机贴现因子,而不是一套单独的技巧对于每个资产类别,科克伦构建现代资产定价的一个统一的帐户。他向股票、债券和期权提交申请。每个模型——基于消费的模型、CAPM模型、多因素模型、期限结构模型和期权定价模型——都是作为贴现因子的不同规范推导出来的。

贴现因子框架也导致了平均方差边界和资产定价模型的状态空间几何。它将支付置于不同的自然状态,而不是收益的均值和方差的坐标轴上,从而形成了一种新的、方便的线性几何形式的资产定价思想。科克伦用广义矩法处理经验工作,该方法研究样本平均价格和折现支付,以确定价格是否等于预期折现支付。

他在折现因子、GMM和状态空间语言与beta、均值-方差和回归语言之间进行了转换,这些语言在经验工作和早期理论中很常见。这本书还包括对最近的实证工作的回顾,在回报可预测性,价值和其他难题的横截面,股票溢价难题和他们的解决。这本书是为学术和专业人士编写的一个总结,也是一本教科书,它浓缩和推进了金融经济学的最新学术成果。

作者简介

John H. Cochrane is Theodore O. Yntema Professor of Finance at the University of Chicago Graduate School of Business. He is Director of the National Bureau of Economic Research Asset Pricing Program.

John H. Cochrane是芝加哥大学商学院Theodore O. Yntema金融学教授。他是美国国家经济研究局资产定价项目主任。

- 中商进口商城 (微信公众号认证)

- 中商进口商城为香港联合出版集团旗下中华商务贸易公司所运营的英美日韩港台原版图书销售平台,旨在向内地读者介绍、普及、引进最新最有价值的国外和港台图书和资讯。

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...