战胜华尔街 英文原版 Beating the Street 全球基金经理 彼得林奇 Peter Lynch 选股实录 商业经济 投资黄金法则 英文版进口书

| 运费: | ¥ 0.00-999.00 |

| 库存: | 19 件 |

商品详情

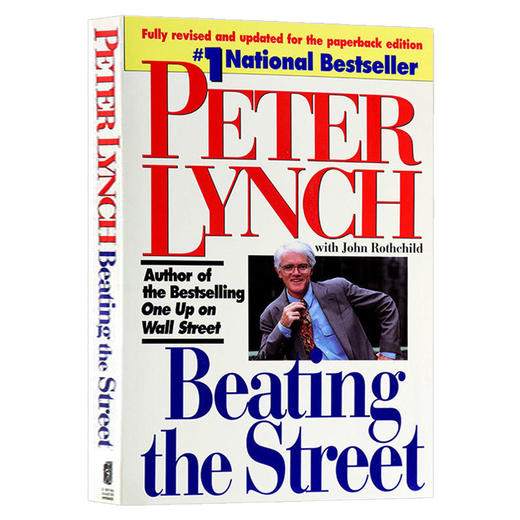

书名:Beating the Street战胜华尔街

书名:Beating the Street战胜华尔街

作者:Peter Lynch

出版社名称:Simon & Schuster

出版时间:1994

语种:英文

ISBN:9780671891633

商品尺寸:14 x 2 x 21.4 cm

包装:平装

页数:336

★彼得·林奇被美国《时代》杂志评为“全球基金经理”,被美国基金评级公司评为“历史上传奇的基金经理”。

★彼得·林奇被美国《时代》杂志评为“全球基金经理”,被美国基金评级公司评为“历史上传奇的基金经理”。★彼得·林奇的选股回忆录——管理麦哲伦基金13年的投资自传,21个选股经典案例,25条投资黄金法则。

★投资很有趣、很刺激,但如果你不下工夫研究基本面,那就会很危险。

他每月走访40-50家公司,一年500-600家公司。

一年行程10万英里,相当于每个工作日400英里。

他持有1400种证券,每天卖出100种股票,买进100种股票。

管理的基金13年间从1800万美元增至140亿美元。

彼得·林奇对投资基金的贡献,就像乔丹对篮球的贡献。

他把基金管理提升到一个新的境界,把选股变成了一门艺术。

本书Beating the Street《战胜华尔街》是继《彼得·林奇的成功投资》之后,彼得·林奇专门为业余投资者写的一本股票投资策略实践指南。它既是一个世界上成功的基金经理的选股回忆录,又是一本难得的选股实践教程和案例集锦;既可以作为《彼得·林奇的成功投资》的进阶读物,也可以作为实操案例使用。

Legendary money manager Peter Lynch explains his own strategies for investing and offers advice for how to pick stocks and mutual funds to assemble a successful investment portfolio.

Develop a Winning Investment Strategy—with Expert Advice from “The Nation’s #1 Money Manager.” Peter Lynch’s “invest in what you know” strategy has made him a household name with investors both big and small.

An important key to investing, Lynch says, is to remember that stocks are not lottery tickets. There’s a company behind every stock and a reason companies—and their stocks—perform the way they do. In this book, Peter Lynch shows you how you can become an expert in a company and how you can build a profitable investment portfolio, based on your own experience and insights and on straightforward do-it-yourself research.

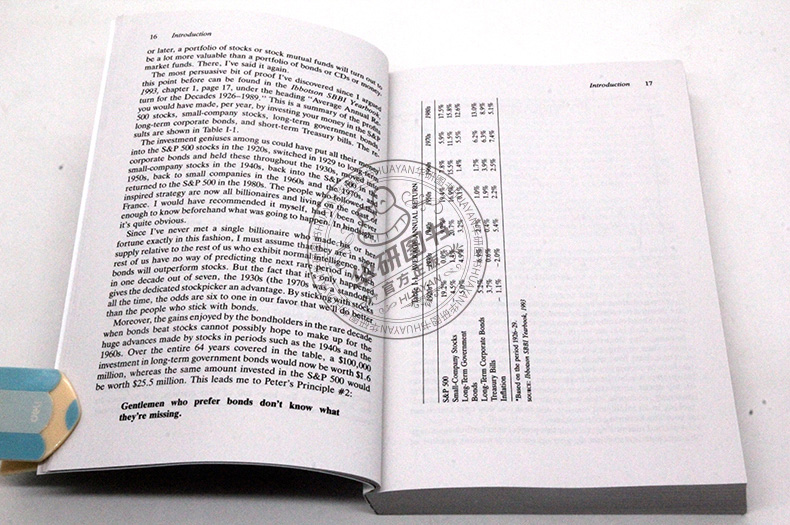

In Beating the Street, Lynch for the first time explains how to devise a mutual fund strategy, shows his step-by-step strategies for picking stock, and describes how the individual investor can improve his or her investment performance to rival that of the experts.

There’s no reason the individual investor can’t match wits with the experts, and this book will show you how.

In Beating the Street, Lynch for the first time:

* Explains how to devise a mutual fund strategy

* Shows how he goes about picking stocks, step-by-step

* Describes how the individual investor can improve his or her investment performance to rival that of the experts of the investment clubs.

Beating the Street《战胜华尔街》是林奇专门为业余投资者写的一本股票投资策略实践指南:林奇本人是如何具体实践自己的投资方法,如何选股,如何管理投资组合,从而连续13年战胜市场的。林奇用自己一生的选股经历,手把手教读者如何正确选股,如何避免选股陷阱,如何选出涨幅大又安全的大牛股。

Beating the Street《战胜华尔街》是林奇专门为业余投资者写的一本股票投资策略实践指南:林奇本人是如何具体实践自己的投资方法,如何选股,如何管理投资组合,从而连续13年战胜市场的。林奇用自己一生的选股经历,手把手教读者如何正确选股,如何避免选股陷阱,如何选出涨幅大又安全的大牛股。

重要和精彩的部分——管理麦哲伦基金13年的投资自传。从0.18亿到1亿美元的初期,从1亿到10亿美元的中期,从10亿到140亿美元的晚期,揭示了林奇连续13年战胜市场的三个主要原因:林奇比别人更加吃苦;林奇比别人更加重视调研;林奇比别人更加灵活。

实用的部分——21个选股经典案例,涉及零售业、房地产业、服务业、萧条行业、金融业、周期性行业等。这不仅是林奇选股的具体操作,更是分行业选股的要点指南。

本书归纳总结出的25条投资黄金法则,是林奇用一生成功的经验和失败的教训凝结出来的投资真谛;每一个投资者都应该牢记于心,从而在股市迷宫中找到正确的方向。

彼得·林奇(Peter Lynch)出生于1944年1月19日,是知名的股票投资家和证券投资基金经理。他曾是富达公司(Fidelity)的副主席,富达基金托管人董事会成员之一,现已退休从事于慈善事业。他总结自己的投资经验,陆续写出《彼得·林奇的成功投资》、《战胜华尔街》、《彼得·林奇教你理财》,轰动华尔街。

彼得·林奇(Peter Lynch)出生于1944年1月19日,是知名的股票投资家和证券投资基金经理。他曾是富达公司(Fidelity)的副主席,富达基金托管人董事会成员之一,现已退休从事于慈善事业。他总结自己的投资经验,陆续写出《彼得·林奇的成功投资》、《战胜华尔街》、《彼得·林奇教你理财》,轰动华尔街。

Peter Lynchmanaged the Fidelity Magellan Fund from 1977 to 1990 when it was one of the most successful mutual-funds of all time. He then became a vice chairman at Fidelity and more recently has become a prominent philanthropist particularly active in the Boston area. His books include One Up on Wall Street, Beating the Street, and Learn to Earn (all written with John Rothchild).

Amateur stockpicking is a dying art, like pie-baking, which is losing out to the packaged goods. A vast army of mutual-fund managers is paid handsomely to do for portfolios what Sara Lee did for cakes. I'm sorry this is happening. It bothered me when I was a fund manager, and it bothers me even more now that I have joined the ranks of the nonprofessionals, investing in my spare time.

Amateur stockpicking is a dying art, like pie-baking, which is losing out to the packaged goods. A vast army of mutual-fund managers is paid handsomely to do for portfolios what Sara Lee did for cakes. I'm sorry this is happening. It bothered me when I was a fund manager, and it bothers me even more now that I have joined the ranks of the nonprofessionals, investing in my spare time.

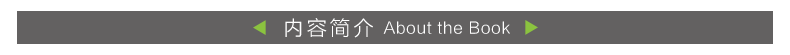

This decline of the amateur accelerated during the great bull market of the 1980s, after which fewer individuals owned stocks than at the beginning. I have tried to determine why this happened. One reason is that the financial press made us Wall Street types into celebrities, a notoriety that was largely undeserved. Stock stars were treated like rock stars, giving the amateur investor the false impression that he or she couldn't possibly hope to compete against so many geniuses with M.B.A. degrees, all wearing Burberry raincoats and armed with Quotrons.

Rather than fight these Burberried geniuses, large numbers of average investors decided to join them by putting their serious money into mutual funds. The fact that up to 75 percent of these mutual funds failed to perform even as well as the stock market averages proves that genius isn't foolproof.

But the main reason for the decline of the amateur stockpicker has to be losses. It's human nature to keep doing something as long as it's pleasurable and you can succeed at it, which is why the world population continues to increase at a rapid rate. Likewise, people continue to collect baseball cards, antique furniture, old fishing lures, coins, and stamps, and they haven't stopped fixing up houses and reselling them, because all these activities can be profitable as well as enjoyable. So if they've gotten out of stocks, it's because they're tired of losing money.

It's usually the wealthier and more successful members of society who have money to put into stocks in the first place, and this group is used to getting A's in school and pats on the back at work. The stock market is the one place where the high achiever is routinely shown up. It's easy to get an F here. If you buy futures and options and attempt to time the market, it's easy to get all F's, which must be what's happened to a lot of people who have fled to the mutual funds.

This doesn't mean they stop buying stocks altogether. Somewhere down the road they get a tip from Uncle Harry, or they overhear a conversation on a bus, or they read something in a magazine and decide to take a flier on a dubious prospect, with their "play" money. This split between serious money invested in the funds and play money for individual stocks is a recent phenomenon, which encourages the stockpicker's caprice. He or she can make these frivolous side bets in a separate account with a discount broker, which the spouse doesn't have to know about.

As stockpicking disappears as a serious hobby, the techniques of how to evaluate a company, the earnings, the growth rate, etc., are being forgotten right along with the old family recipes. With fewer retail clients interested in such information, brokerage houses are less inclined to volunteer it. Analysts are too busy talking to the institutions to worry about educating the masses.

- 华研外语 (微信公众号认证)

- 本店是“华研外语”品牌商自营店,全国所有“华研外语”、“华研教育”品牌图书都是我司出版发行的,本店为华研官方源头出货,所有图书均为正规正版,拥有实惠与正版的保障!!!

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...