商品详情

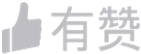

书名:清代税收研究:赋税与国家治理(全2册)

定价:238.0

ISBN:9787030819734

作者:陈锋等

版次:1

出版时间:2025-10

内容提要:

目录:

目录

第一章 绪论:研究前史及清代前期的经济、财政与税收/001

第二章 税收管理

第一节 皇室税收与财政管理机构/043

第二节 中央税收与财政管理机构/052

第三节 地方税收管理机构与特设税收管理机构/060

第四节 赋税征收册籍与钱粮征解、奏销/103

第五节 税收考核与钱粮交代/145

第三章 田赋与徭役

第一节 土地占有、田亩统计与田赋科则/162

第二节 田赋征收/187

第三节 田赋蠲免/198

第四节 徭役征发与摊丁入亩/217

第五节 西北屯田及“租”“税”征收/249

第四章 关税和其他工商税

第一节 清代榷关的设置与税则(税率)/261

第二节 关税征收的变化与征收数额/278

第三节 其他工商税/388

第五章 食盐运销与盐税征收

第一节 盐产区、盐销区的划分与运销方式/405

第二节 盐税税种与征收数额/415

第六章 杂税种类与杂税征收

第一节 杂税种类及其变化/478

第二节 杂税征收原则与征收数额/486

第七章 税外加征

第一节 耗羡加征与耗羡归公/516

第二节 徭役摊派与河工、盐斤加价/531

第三节 陋规的收受/556

第八章 税收思想

第一节 帝王的税收思想/575

第二节 官员的税收思想/594

第三节 思想家的税收思想/608

主要参考文献/621

索引/632

表目录

表1-1 清代前期各朝税收岁入一览/030

表1-2 乾隆十八年岁入统计/031

表1-3 乾隆三十一年岁入统计/032

表2-1 清代前期与后期各清吏司的职掌比较/054

表2-2 常例考成与特别考成比较/154

表3-1 顺治年间人丁、亩额、田赋统计/163

表3-2 安徽塘、地、山一亩折田数额/175

表3-3 安徽塘、地、山若干折田一亩/175

表3-4 明代弘治年间徽州府歙县田赋科则/176

表3-5 清初安徽有关府县田赋科则/176

表3-6 顺治年间土地开垦统计/183

表3-7 顺治、康熙两朝田赋本色、折色征收统计与比较/188

表3-8 清初山东、河南的蠲荒征熟/203

表3-9 直隶等省平时转运军粮、饷银脚价标准/226

表3-10 摊丁入亩简表/244

表4-1 明代万历年间江南关税(船钞)征收则例/273

表4-2 明代崇祯五年江南关税(船钞)征收则例/274

表4-3 顺治十二年江南关税(船钞)征收则例/274

表4-4 康熙二十五年江南关税(船钞)征收则例/275

表4-5 雍正年间各关征收盈余银数量/286

表4-6 嘉庆初年各关正额银、盈余银/292

表4-7 浒墅关嘉庆至道光年间盈余银多收或少收额数/296

表4-8 清代前期各朝关税征收数额统计/303

表4-9 乾隆至道光年间浒墅关历年税收总额、正额与盈余银/317

表4-10 乾隆初年浒墅关各项经费支出及盈余银贴补/321

表4-11 乾隆至道光年间九江关历年税收总额、正额与盈余银/324

表4-12 乾隆至道光年间九江关实征盈余银及经费动用盈余银/327

表4-13 乾隆至道光年间山…实征、支发及解交内务府盈余银/333

表4-14 乾隆至道光年间张家口实征、支发及解交内务府盈余银/337

表4-15 乾隆至道光年间杀虎口实征、支发及解交内务府盈余银/341

表4-16 咸丰以降左翼实征、支发及解交内务府盈余银/345

表4-17 鸦片战争以降右翼实征、支发及解交内务府盈余银/346

表4-18 天津关乾隆至道光年间实收盈余银、净盈余银及

额外盈余银/357

表4-19 凤阳关乾隆至道光年间解交造办处的款项、银两/363

表4-20 浒墅关(苏州织造)乾隆至道光年间解交内务府的平余银两/375

表4-21 浒墅关(苏州织造)嘉庆至道光年间罚料等银及解交内务府的银两/382

表4-22 道光年间苏州等府牙行及牙税、耗羡的征收/394

表4-23 康熙、乾隆年间牙税统计/396

表4-24 道光年间苏州等府当铺及当税、耗羡的征收/400

表4-25 康熙、乾隆年间当税统计/401

表5-1 明清两代销盐区域对照表/408

表5-2 长芦场课项目与征银额/417

表5-3 各盐区场课一览表/420

表5-4 两淮等盐区顺治年间“加引增课”与原额正课的比较/426

表5-5 各盐区征纳铜斤、河工银额统计/431

表5-6 顺治至雍正朝盐课岁入/433

表5-7 乾隆至道光朝盐课岁入/436

表5-8 两淮盐区三藩之乱前后的盐课额/438

表6-1 康熙二十四年各省契税及“杂赋”/489

表6-2 雍正至道光年间广东契税的正额银与溢额银/491

表7-1 雍正年间的耗羡征收比例与数额/520

表7-2 耗羡归公银中养廉银与公费银的比例/524

表7-3 各省起运正银、耗银与存留正银、耗银/528

表7-4 长芦盐区嘉庆以前的补贴加价/540

表7-5 两淮雍正年间裁革浮费陋规细目/567

插图目录

图2-1 长芦盐运使司印/075

图3-1 安徽余瞻明等户土地丈量图(清代,具体时间不详)/171

图3-2 安徽县十一都二图三甲汪笃祀李字五千七百三十三号丈量佥归票(康熙二十二年十一月)/171

图3-3 安徽休宁县十八都九图丈量山地塘宝字三十四号纬税票(道光二十三年十二月)/172

图6-1 《杂税全书》书影/489

图7-1 “剀切出示晓谕碑”/558

图7-2 “剀切出示晓谕碑”局部/558

CONTENTS

Chapter I Introduction/001

Chapter II Taxation Management

Section 1 Royal Taxation and Fiscal Administrative Institutions/043

Section 2 Central Taxation and Fiscal Administrative Institutions/052

Section 3 Local Taxation Administrative Institutions and Special

Agencies Administrative Institutions/060

Section 4 The Tax Collection Registers, Money and Grain Levying, and Financial Submitting to the Imperial Court/103

Section 5 Taxation Assessment and the Money and Grain Transfer System/145

Chapter III Land Tax and Corvée

Section 1 Land Ownership, Land Area Statistics, and Land Tax Regulations/162

Section 2 Land Tax Levying/187

Section 3 Exemptions from Land Tax/198

Section 4 Corvée and the Integration of Poll Tax into Land/217

Section 5 Military Land in the Northwest China and “Rent” and “Tax”Levying/249

Chapter IV Customs Duties and Other Commercial and Industrial Taxes

Section 1 Establishment of Trade Customs and Tax Rates in the Qing Dynasty/261

Section 2 Changes in Customs Duty Levying and Revenue Amounts/278

Section 3 Other Commercial and Industrial Taxes/388

Chapter V Salt Distribution and Salt Tax Levying

Section 1 Division of Salt Production and Marketing Regions, and Methods of Salt Transportation and Sales/405

Section 2 Types of Salt Taxes and Revenue Amounts/415

Chapter VI Miscellaneous Tax’ Types and Levying

Section 1 Types of Miscellaneous Taxes and Their Changes/478

Section 2 Principles of Miscellaneous Tax Levying and Revenue Amounts/486

Chapter VII Additional Levies Beyond Regular Taxes

Section 1 Additional Levies on Meltage Fee and Turn Meltage Fee Revenue to the State/516

Section 2 Corvée Apportion and Increased Salt Prices/531

Section 3 Receiving Corrupt Rules/556

Chapter VIII Taxation Ideology

Section 1 The Taxation Ideology of Emperors/575

Section 2 The Taxation Ideology of Officials/594

Section 3 The Taxation Ideology of Thinkers/608

References/621

Index/632

Table Directory

Table 1-1 Annual Tax Revenue of Each Reign in the Early Qing Dynasty/030

Table 1-2 Statistics of Tax Revenues in the 18th Year of Qianlong/031

Table 1-3 Statistics of Tax Revenues in the 31st Year of the Qianlong/032

Table 2-1 Comparison of the Administrative Functions of Qingli Department in the Early and Late Qing Dynasties/054

Table 2-2 Comparison between Regular Assessments and Special Assessments/154

Table 3-1 Statistics of the Population, Acreage, and Land Tax during the Shunzhi Reign/163

Table 3-2 Conversion Amounts of Ponds, Lands, and Hills into Standard Farmland in Anhui Province/175

Table 3-3 Reverse Conversion from Standard Acres to Ponds, Lands, and Hills in Anhui Province/175

Table 3-4 Land Tax in She County, Huizhou Prefecture during the Hongzhi Reign in Ming Dynasty/176

Table 3-5 Land Tax in Relevant Prefectures and Counties of Anhui Province in the Early Qing Dynasty/176

Table 3-6 Statistics of Land Reclamation during the Shunzhi Reign/183

Table 3-7 Statistics and Comparison of Standard and Converted Tax Collection in the Shunzhi and Kangxi Reigns/188

Table 3-8 Tax Exemptions for Disaster-affected Land in Shandong and Henan Provinces in the Early Qing Dynasty/203

Table 3-9 Transportation Charges for Military Grain and Silver in Zhili and Other Provinces in Normal Times/226

Table 3-10 Summary of the “Integration of Poll Tax into Land Tax” Policy/244

Table 4-1 Customs Duty Regulation (Ship Tax) in Jiangnan Region during the Wanli Reign in Ming Dynasty/273

Table 4-2 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 5th Year of Chongzhen/274

Table 4-3 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 12th Year of Shunzhi/274

Table 4-4 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 25th Year of Kangxi/275

Table 4-5 The Amount of Surplus Silver Collected by Each Customs during the Yongzheng Reign/286

Table 4-6 Official Quota and Surplus Silver Collected by Each Customs in the Early Jiaqing Reign/292

Table 4-7 Excess or Shortfall Collected Surplus Silver at Hushu from Jiaqing Reign to Daoguang Reign/296

Table 4-8 Statistics of Customs Duties Collected in Each Reign in the Early Qing Dynasty/303

Table 4-9 Annual Revenue, Official Quota, and Surplus Silver of Hushu from Qianlong to Daoguang Reigns/317

Table 4-10 Expenditures and Surplus Silver Subsidy of Hushu in the Early Qianlong Reign/321

Table 4-11 Annual Revenue, Official Quota, and Surplus Silver of Jiujiang Customs from Qianlong to Daoguang Reigns/324

Table 4-12 Actual Collected and Used Surplus Silver at Jiujiang Customs from Qianlong to Daoguang Reigns/327

Table 4-13 Actual Collection, Disbursement, and Transfer of Surplus Silver from Shanhaiguan Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/333

Table 4-14 Actual Collection, Disbursement, and Transfer of Surplus Silver from Zhangjiakou Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/337

Table Directory 013

Table 4-15 Actual Collection, Disbursement, and Transfer of Surplus Silver from Shahukou Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/341

Table 4-16 Actual Collection, Disbursement, and Transfer of Surplus Silver from ZuoYi to the Imperial Household Department since Xianfeng Reign/345

Table 4-17 Actual Collection, Disbursement, and Transfer of Surplus Silver from YouYi to the Imperial Household Department since the Opium War/346

Table 4-18 Surplus Silver, Net Surplus Silver, and Additional Surplus Silver at Tianjin Customs from Qianlong to Daoguang Reign/357

Table 4-19 The Funds and Silver Delivered to the Imperial Workshops by Fengyang Customs from Qianlong to Daoguang Reign/363

Table 4-20 Pingyu Silver Transferred to the Imperial Household by Hushu Customs (Suzhou Weaving Bureau) from Qianlong to Daoguang Reign/375

Table 4-21 Punished and Delivered Silver to the Imperial Household by Hushu Customs (Suzhou Weaving Bureau) from Jiaqing to Daoguang

Reign/382

Table 4-22 Broker Taxes and Related Charges in Suzhou and Nearby Prefectures’Intermediary Organizations during Daoguang Reign/394

Table 4-23 Statistics of Broker Taxes in Kangxi and Qianlong Reigns/396

Table 4-24 Pawnshop Tax and Related Charges in Suzhou and Other Prefectures in Daoguang Reign/400

Table 4-25 Statistics of Pawnshop Tax in Kangxi and Qianlong Reigns/401

Table 5-1 A Comparison Table of Salt Sales Regions in the Ming and Qing

Dynasties/408

Table 5-2 Taxation Items and Silver Quotas at Changlu Salt District/417

Table 5-3 A Table of Salt Taxation in Each Salt District/420

Table 5-4 A Comparison between Increased Salt Duties and Original Tax in Lianghuai Districts during Shunzhi/426

Table 5-5 The Amount of Copper and Riverwork Silver Levied on Each Salt District/431

Table 5-6 Annual Salt Revenue from Shunzhi to Yongzheng Reigns/433

Table 5-7 Annual Salt Revenue from Qianlong to Daoguang Reign/436

Table 5-8 Salt Tax Revenue in Lianghuai Districts before and after the Rebellion of the Three Feudatories/438

Table 6-1 The Amount of Deed Tax and Miscellaneous Levies in Each Province in the 24th Year of Kangxi/489

Table 6-2 Official Quotas and Surplus Revenue from Deed Tax in Guangdong Province from Yongzheng to Daoguang Reigns/491

Table 7-1 Rates and Amounts of Additional Levies on Meltage Fee during

Yongzheng Reign/520

Table 7-2 Proportion of Meltage Fee Revenue Allocated to Honesty Silver and Public Expense/524

Table 7-3 Regular Silver and Meltage Fee for Transfer to the Central Government and Local Retention in Each Province/528

Table 7-4 Supplemental Price Adjustments in the Changlu Salt District before Jiaqing Reign/540

Table 7-5 The List of Abolishing Excessive Fees in Lianghuai Salt District during Yongzheng Reign/567

Figure Directory

Figure 2-1 Seal of the Changlu Salt Commission/075

Figure 3-1 Land Survey Map of Yu Zhanming and Other Households in Anhui (Qing Dynasty, specific date unknown), Huangshan City Archives, Anhui Province/171

Figure 3-2 Land Survey Document for Plot No. 5733 of Li Surname, in the Third Jia, Second Tu, Eleventh Du, County, Anhui Province/171

Figure 3-3 Tax Certificate for Hill and Pond Survey, Plot No. 34 of Bao Character in the Nineth Tu, Eighteenth Du, Xiuning County, Anhui Province/172

Figure 6-1 A Photo of the Book “Compendium of Miscellaneous Taxes ”(Zashui Quanshu)/489

Figure 7-1 The Inscription of “Earnestly educated and Issued Public Notice Stele”/558

Figure 7-2 Detail of the Stele Inscription/558

定价:238.0

ISBN:9787030819734

作者:陈锋等

版次:1

出版时间:2025-10

内容提要:

本书是系统研究清代税收的著作,采取广角度、大视野的“大财政史观”论述税收史。分为上、下两册,上册主要论述传统的较为固定的税收管理制度,田赋、盐课、关税、杂税等主要税种及税外加征。下册主要论述清代后期的税收制度、税收变革和税收思想的变化,除了分析传统税种的内涵和外延变化外,重点探讨了新…的设置与…税的征收奏销、厘金种类与厘金税率变动、杂税与杂捐的地域性特征、晚清财权下移与地方税收权的形成、国家税与地方税的划分模式。上、下两册采取不同的研究模式和研究方法,通过“变”与“不变”的逻辑结构和研究方法,缕述税收的变化,分析税收与国家财政治理能力的关系,揭示中国传统的税收财政制度在内外因素共同作用下向现代艰难转型的内在逻辑和历史规律。

目录:

目录

第一章 绪论:研究前史及清代前期的经济、财政与税收/001

第二章 税收管理

第一节 皇室税收与财政管理机构/043

第二节 中央税收与财政管理机构/052

第三节 地方税收管理机构与特设税收管理机构/060

第四节 赋税征收册籍与钱粮征解、奏销/103

第五节 税收考核与钱粮交代/145

第三章 田赋与徭役

第一节 土地占有、田亩统计与田赋科则/162

第二节 田赋征收/187

第三节 田赋蠲免/198

第四节 徭役征发与摊丁入亩/217

第五节 西北屯田及“租”“税”征收/249

第四章 关税和其他工商税

第一节 清代榷关的设置与税则(税率)/261

第二节 关税征收的变化与征收数额/278

第三节 其他工商税/388

第五章 食盐运销与盐税征收

第一节 盐产区、盐销区的划分与运销方式/405

第二节 盐税税种与征收数额/415

第六章 杂税种类与杂税征收

第一节 杂税种类及其变化/478

第二节 杂税征收原则与征收数额/486

第七章 税外加征

第一节 耗羡加征与耗羡归公/516

第二节 徭役摊派与河工、盐斤加价/531

第三节 陋规的收受/556

第八章 税收思想

第一节 帝王的税收思想/575

第二节 官员的税收思想/594

第三节 思想家的税收思想/608

主要参考文献/621

索引/632

表目录

表1-1 清代前期各朝税收岁入一览/030

表1-2 乾隆十八年岁入统计/031

表1-3 乾隆三十一年岁入统计/032

表2-1 清代前期与后期各清吏司的职掌比较/054

表2-2 常例考成与特别考成比较/154

表3-1 顺治年间人丁、亩额、田赋统计/163

表3-2 安徽塘、地、山一亩折田数额/175

表3-3 安徽塘、地、山若干折田一亩/175

表3-4 明代弘治年间徽州府歙县田赋科则/176

表3-5 清初安徽有关府县田赋科则/176

表3-6 顺治年间土地开垦统计/183

表3-7 顺治、康熙两朝田赋本色、折色征收统计与比较/188

表3-8 清初山东、河南的蠲荒征熟/203

表3-9 直隶等省平时转运军粮、饷银脚价标准/226

表3-10 摊丁入亩简表/244

表4-1 明代万历年间江南关税(船钞)征收则例/273

表4-2 明代崇祯五年江南关税(船钞)征收则例/274

表4-3 顺治十二年江南关税(船钞)征收则例/274

表4-4 康熙二十五年江南关税(船钞)征收则例/275

表4-5 雍正年间各关征收盈余银数量/286

表4-6 嘉庆初年各关正额银、盈余银/292

表4-7 浒墅关嘉庆至道光年间盈余银多收或少收额数/296

表4-8 清代前期各朝关税征收数额统计/303

表4-9 乾隆至道光年间浒墅关历年税收总额、正额与盈余银/317

表4-10 乾隆初年浒墅关各项经费支出及盈余银贴补/321

表4-11 乾隆至道光年间九江关历年税收总额、正额与盈余银/324

表4-12 乾隆至道光年间九江关实征盈余银及经费动用盈余银/327

表4-13 乾隆至道光年间山…实征、支发及解交内务府盈余银/333

表4-14 乾隆至道光年间张家口实征、支发及解交内务府盈余银/337

表4-15 乾隆至道光年间杀虎口实征、支发及解交内务府盈余银/341

表4-16 咸丰以降左翼实征、支发及解交内务府盈余银/345

表4-17 鸦片战争以降右翼实征、支发及解交内务府盈余银/346

表4-18 天津关乾隆至道光年间实收盈余银、净盈余银及

额外盈余银/357

表4-19 凤阳关乾隆至道光年间解交造办处的款项、银两/363

表4-20 浒墅关(苏州织造)乾隆至道光年间解交内务府的平余银两/375

表4-21 浒墅关(苏州织造)嘉庆至道光年间罚料等银及解交内务府的银两/382

表4-22 道光年间苏州等府牙行及牙税、耗羡的征收/394

表4-23 康熙、乾隆年间牙税统计/396

表4-24 道光年间苏州等府当铺及当税、耗羡的征收/400

表4-25 康熙、乾隆年间当税统计/401

表5-1 明清两代销盐区域对照表/408

表5-2 长芦场课项目与征银额/417

表5-3 各盐区场课一览表/420

表5-4 两淮等盐区顺治年间“加引增课”与原额正课的比较/426

表5-5 各盐区征纳铜斤、河工银额统计/431

表5-6 顺治至雍正朝盐课岁入/433

表5-7 乾隆至道光朝盐课岁入/436

表5-8 两淮盐区三藩之乱前后的盐课额/438

表6-1 康熙二十四年各省契税及“杂赋”/489

表6-2 雍正至道光年间广东契税的正额银与溢额银/491

表7-1 雍正年间的耗羡征收比例与数额/520

表7-2 耗羡归公银中养廉银与公费银的比例/524

表7-3 各省起运正银、耗银与存留正银、耗银/528

表7-4 长芦盐区嘉庆以前的补贴加价/540

表7-5 两淮雍正年间裁革浮费陋规细目/567

插图目录

图2-1 长芦盐运使司印/075

图3-1 安徽余瞻明等户土地丈量图(清代,具体时间不详)/171

图3-2 安徽县十一都二图三甲汪笃祀李字五千七百三十三号丈量佥归票(康熙二十二年十一月)/171

图3-3 安徽休宁县十八都九图丈量山地塘宝字三十四号纬税票(道光二十三年十二月)/172

图6-1 《杂税全书》书影/489

图7-1 “剀切出示晓谕碑”/558

图7-2 “剀切出示晓谕碑”局部/558

CONTENTS

Chapter I Introduction/001

Chapter II Taxation Management

Section 1 Royal Taxation and Fiscal Administrative Institutions/043

Section 2 Central Taxation and Fiscal Administrative Institutions/052

Section 3 Local Taxation Administrative Institutions and Special

Agencies Administrative Institutions/060

Section 4 The Tax Collection Registers, Money and Grain Levying, and Financial Submitting to the Imperial Court/103

Section 5 Taxation Assessment and the Money and Grain Transfer System/145

Chapter III Land Tax and Corvée

Section 1 Land Ownership, Land Area Statistics, and Land Tax Regulations/162

Section 2 Land Tax Levying/187

Section 3 Exemptions from Land Tax/198

Section 4 Corvée and the Integration of Poll Tax into Land/217

Section 5 Military Land in the Northwest China and “Rent” and “Tax”Levying/249

Chapter IV Customs Duties and Other Commercial and Industrial Taxes

Section 1 Establishment of Trade Customs and Tax Rates in the Qing Dynasty/261

Section 2 Changes in Customs Duty Levying and Revenue Amounts/278

Section 3 Other Commercial and Industrial Taxes/388

Chapter V Salt Distribution and Salt Tax Levying

Section 1 Division of Salt Production and Marketing Regions, and Methods of Salt Transportation and Sales/405

Section 2 Types of Salt Taxes and Revenue Amounts/415

Chapter VI Miscellaneous Tax’ Types and Levying

Section 1 Types of Miscellaneous Taxes and Their Changes/478

Section 2 Principles of Miscellaneous Tax Levying and Revenue Amounts/486

Chapter VII Additional Levies Beyond Regular Taxes

Section 1 Additional Levies on Meltage Fee and Turn Meltage Fee Revenue to the State/516

Section 2 Corvée Apportion and Increased Salt Prices/531

Section 3 Receiving Corrupt Rules/556

Chapter VIII Taxation Ideology

Section 1 The Taxation Ideology of Emperors/575

Section 2 The Taxation Ideology of Officials/594

Section 3 The Taxation Ideology of Thinkers/608

References/621

Index/632

Table Directory

Table 1-1 Annual Tax Revenue of Each Reign in the Early Qing Dynasty/030

Table 1-2 Statistics of Tax Revenues in the 18th Year of Qianlong/031

Table 1-3 Statistics of Tax Revenues in the 31st Year of the Qianlong/032

Table 2-1 Comparison of the Administrative Functions of Qingli Department in the Early and Late Qing Dynasties/054

Table 2-2 Comparison between Regular Assessments and Special Assessments/154

Table 3-1 Statistics of the Population, Acreage, and Land Tax during the Shunzhi Reign/163

Table 3-2 Conversion Amounts of Ponds, Lands, and Hills into Standard Farmland in Anhui Province/175

Table 3-3 Reverse Conversion from Standard Acres to Ponds, Lands, and Hills in Anhui Province/175

Table 3-4 Land Tax in She County, Huizhou Prefecture during the Hongzhi Reign in Ming Dynasty/176

Table 3-5 Land Tax in Relevant Prefectures and Counties of Anhui Province in the Early Qing Dynasty/176

Table 3-6 Statistics of Land Reclamation during the Shunzhi Reign/183

Table 3-7 Statistics and Comparison of Standard and Converted Tax Collection in the Shunzhi and Kangxi Reigns/188

Table 3-8 Tax Exemptions for Disaster-affected Land in Shandong and Henan Provinces in the Early Qing Dynasty/203

Table 3-9 Transportation Charges for Military Grain and Silver in Zhili and Other Provinces in Normal Times/226

Table 3-10 Summary of the “Integration of Poll Tax into Land Tax” Policy/244

Table 4-1 Customs Duty Regulation (Ship Tax) in Jiangnan Region during the Wanli Reign in Ming Dynasty/273

Table 4-2 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 5th Year of Chongzhen/274

Table 4-3 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 12th Year of Shunzhi/274

Table 4-4 Customs Duty Regulation (Ship Tax) in Jiangnan Region in the 25th Year of Kangxi/275

Table 4-5 The Amount of Surplus Silver Collected by Each Customs during the Yongzheng Reign/286

Table 4-6 Official Quota and Surplus Silver Collected by Each Customs in the Early Jiaqing Reign/292

Table 4-7 Excess or Shortfall Collected Surplus Silver at Hushu from Jiaqing Reign to Daoguang Reign/296

Table 4-8 Statistics of Customs Duties Collected in Each Reign in the Early Qing Dynasty/303

Table 4-9 Annual Revenue, Official Quota, and Surplus Silver of Hushu from Qianlong to Daoguang Reigns/317

Table 4-10 Expenditures and Surplus Silver Subsidy of Hushu in the Early Qianlong Reign/321

Table 4-11 Annual Revenue, Official Quota, and Surplus Silver of Jiujiang Customs from Qianlong to Daoguang Reigns/324

Table 4-12 Actual Collected and Used Surplus Silver at Jiujiang Customs from Qianlong to Daoguang Reigns/327

Table 4-13 Actual Collection, Disbursement, and Transfer of Surplus Silver from Shanhaiguan Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/333

Table 4-14 Actual Collection, Disbursement, and Transfer of Surplus Silver from Zhangjiakou Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/337

Table Directory 013

Table 4-15 Actual Collection, Disbursement, and Transfer of Surplus Silver from Shahukou Customs to the Imperial Household Department from

Qianlong to Daoguang Reigns/341

Table 4-16 Actual Collection, Disbursement, and Transfer of Surplus Silver from ZuoYi to the Imperial Household Department since Xianfeng Reign/345

Table 4-17 Actual Collection, Disbursement, and Transfer of Surplus Silver from YouYi to the Imperial Household Department since the Opium War/346

Table 4-18 Surplus Silver, Net Surplus Silver, and Additional Surplus Silver at Tianjin Customs from Qianlong to Daoguang Reign/357

Table 4-19 The Funds and Silver Delivered to the Imperial Workshops by Fengyang Customs from Qianlong to Daoguang Reign/363

Table 4-20 Pingyu Silver Transferred to the Imperial Household by Hushu Customs (Suzhou Weaving Bureau) from Qianlong to Daoguang Reign/375

Table 4-21 Punished and Delivered Silver to the Imperial Household by Hushu Customs (Suzhou Weaving Bureau) from Jiaqing to Daoguang

Reign/382

Table 4-22 Broker Taxes and Related Charges in Suzhou and Nearby Prefectures’Intermediary Organizations during Daoguang Reign/394

Table 4-23 Statistics of Broker Taxes in Kangxi and Qianlong Reigns/396

Table 4-24 Pawnshop Tax and Related Charges in Suzhou and Other Prefectures in Daoguang Reign/400

Table 4-25 Statistics of Pawnshop Tax in Kangxi and Qianlong Reigns/401

Table 5-1 A Comparison Table of Salt Sales Regions in the Ming and Qing

Dynasties/408

Table 5-2 Taxation Items and Silver Quotas at Changlu Salt District/417

Table 5-3 A Table of Salt Taxation in Each Salt District/420

Table 5-4 A Comparison between Increased Salt Duties and Original Tax in Lianghuai Districts during Shunzhi/426

Table 5-5 The Amount of Copper and Riverwork Silver Levied on Each Salt District/431

Table 5-6 Annual Salt Revenue from Shunzhi to Yongzheng Reigns/433

Table 5-7 Annual Salt Revenue from Qianlong to Daoguang Reign/436

Table 5-8 Salt Tax Revenue in Lianghuai Districts before and after the Rebellion of the Three Feudatories/438

Table 6-1 The Amount of Deed Tax and Miscellaneous Levies in Each Province in the 24th Year of Kangxi/489

Table 6-2 Official Quotas and Surplus Revenue from Deed Tax in Guangdong Province from Yongzheng to Daoguang Reigns/491

Table 7-1 Rates and Amounts of Additional Levies on Meltage Fee during

Yongzheng Reign/520

Table 7-2 Proportion of Meltage Fee Revenue Allocated to Honesty Silver and Public Expense/524

Table 7-3 Regular Silver and Meltage Fee for Transfer to the Central Government and Local Retention in Each Province/528

Table 7-4 Supplemental Price Adjustments in the Changlu Salt District before Jiaqing Reign/540

Table 7-5 The List of Abolishing Excessive Fees in Lianghuai Salt District during Yongzheng Reign/567

Figure Directory

Figure 2-1 Seal of the Changlu Salt Commission/075

Figure 3-1 Land Survey Map of Yu Zhanming and Other Households in Anhui (Qing Dynasty, specific date unknown), Huangshan City Archives, Anhui Province/171

Figure 3-2 Land Survey Document for Plot No. 5733 of Li Surname, in the Third Jia, Second Tu, Eleventh Du, County, Anhui Province/171

Figure 3-3 Tax Certificate for Hill and Pond Survey, Plot No. 34 of Bao Character in the Nineth Tu, Eighteenth Du, Xiuning County, Anhui Province/172

Figure 6-1 A Photo of the Book “Compendium of Miscellaneous Taxes ”(Zashui Quanshu)/489

Figure 7-1 The Inscription of “Earnestly educated and Issued Public Notice Stele”/558

Figure 7-2 Detail of the Stele Inscription/558

- 科学出版社旗舰店 (微信公众号认证)

- 科学出版社秉承多年来形成的“高层次、高水平、高质量”和“严肃、严密、严格”的优良传统与作风,始终坚持为科技创新服务、为传播与普及科学知识服务、为科学家和广大读者服务的宗旨。

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...

![[按需印刷]对分课堂之高校思想政治理论课](https://img01.yzcdn.cn/upload_files/2022/10/24/Fr06G2Ek4yAMe52ktjbYilzcz8ej.jpg?imageView2/2/w/260/h/260/q/75/format/jpg)