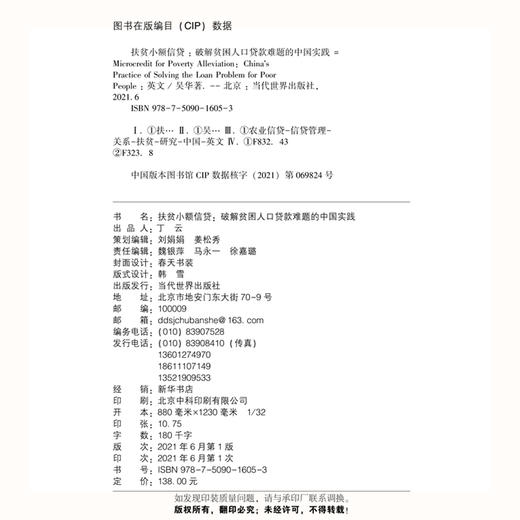

商品详情

作者简介

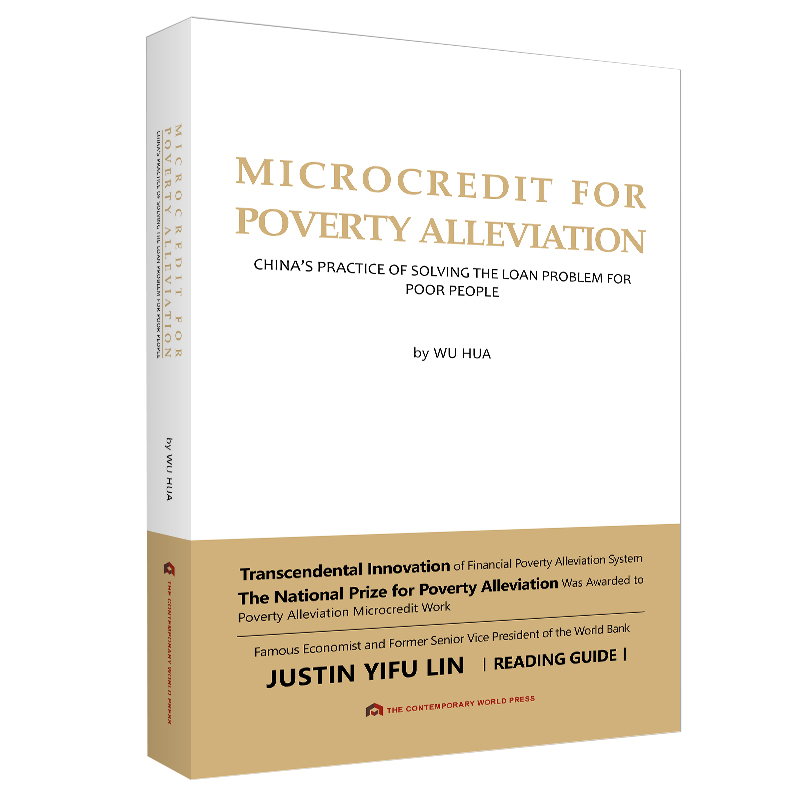

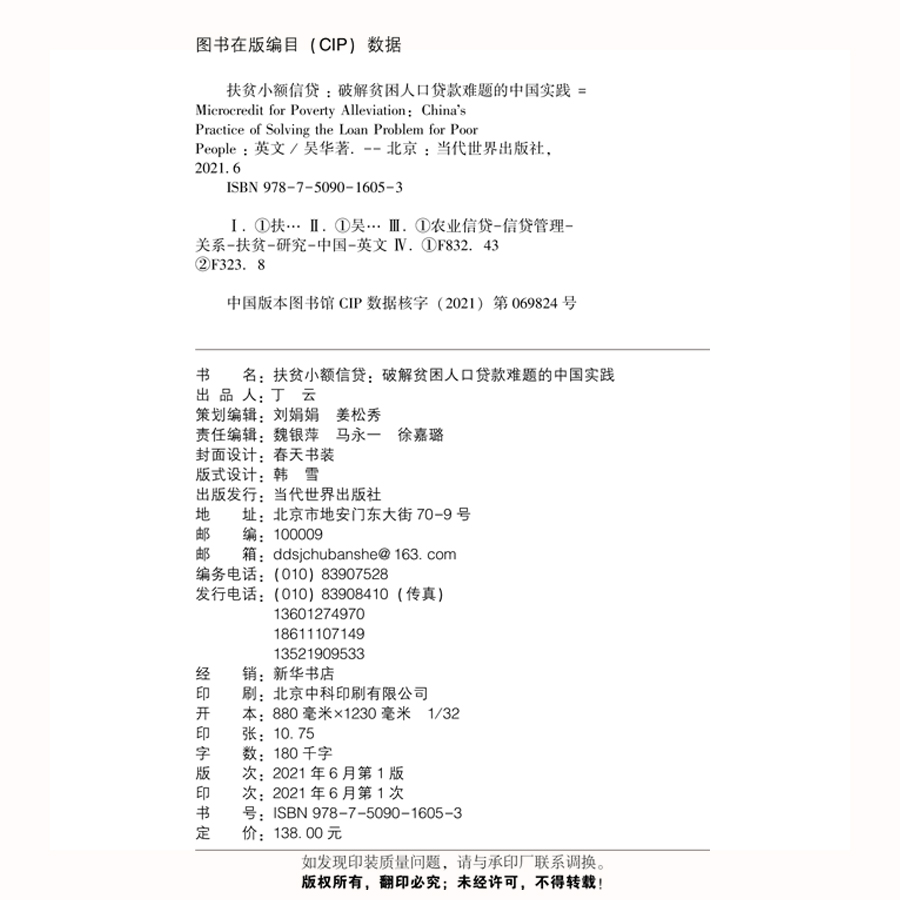

吴华,国务院扶贫办开发指导司一级巡视员。

内容简介

该书以破解贫困农户贷款难为靶向,创新提出扶贫小额信贷的顶层设计和制度安排;以助力打赢脱贫攻坚战为背景,深度阐述扶贫小额信贷政策的创新过程、政策要点、实施情况和主要成效;以贫困农户贷款、用款、还款全流程为主线,详细分析扶贫小额信贷如何去除贷款门槛、提高资金使用效益和加强风险防控,确保贫困农户“贷得到”“用得好”“还得上”;以金融扶贫制度创新为理论升华,全面总结扶贫小额信贷实践孕育的理论价值。

著名经济学家、世界银行前高级副行长林毅夫为此书撰写序言,他认为此书对扶贫小额信贷政策的经验和特点做了全面总结,并“为我国后续做好普惠金融服务,巩固脱贫攻坚成果,助力实施乡村振兴战略提供了有益启示”。

目录

Foreword / 1

Chapter Ⅰ Loans for the Poor--A Worldwide Problem

Ⅰ. 1 " Four Lows" of Poor Households/17

Ⅰ. 2 " Four Worries" of Financial Institutions/22

Ⅰ. 3 " Four Difficulties" of Government Departments/28

Chapter Ⅱ Innovation of Poverty Alleviation Microcredit Products

Ⅱ. 1 Policy Design/35

Ⅱ. 2 Implementation/51

Ⅱ. 3 Preliminary Achievement/64

Chapter Ⅲ Solve the Problem of "Obtaining the Loans"

Ⅲ. 1 Removing Threshold by Government Credit Enhancement/73

Ⅲ. 2 Setting the Loan Limit by Credit Rating/84

Ⅲ. 3 Improving Service by Departments Collaboration/96

Chapter Ⅳ Solve the Problem of "Making Good Use"

Ⅳ. 1 Defining the Purpose of the Loan/111

Ⅳ. 2 Standardizing the Usage of the Loan/118

Ⅳ. 3 Improving the Use Efficiency of the Loan/128

Chapter Ⅴ Solve the Problem of "Repaying"

Ⅴ. 1 Based on Regulation and Monitoring/139

Ⅴ. 2 Sticking to "Prevention First"/153

Ⅴ. 3 Valuing Classified Handling/162

Chapter Ⅵ Typical Cases

Ⅵ. 1 Poverty Alleviation Microcredit Case of Anhui Province/169

Ⅵ. 2 Poverty Alleviation Microcredit Case of Yanchi County/193

Ⅵ. 3 Poverty Alleviation Microcredit Case of Baogou Village/218

Chapter Ⅶ Innovation of Financial Poverty Alleviation System with Chinese Characteristics

Ⅶ. 1 Innovation of Financial Poverty Alleviation System/251

Ⅶ. 2 Innovation Highlighting Advantages of Chinese Characteristics/272

Ⅶ. 3 Consolidating and Deepening the Achievements of Institutional Innovation/285

Appendix Operational Guidelines for Poverty Alleviation Microcredit/293

Postscript/307

Afterword/313

书 摘

Faced with the worldwide difficulty of loans for poor people, General Secretary Xi Jinping put forward to do a good job in financial poverty alleviation. With the support of the China Banking and Insurance Regulatory Commission, the Ministry of Finance and the People's Bank of China, the State Council Leading Group Office of Poverty Alleviation and Development has carried out scientific top-level design, adhered to the principle of "orientation, precision, preferential treatment and innovation", promoted the structural reform of the financial supply side, and innovated policies, products and services. Preferential financial credit loans with "less than 50,000 yuan, within three years, free of guarantee and mortgage, benchmark interest rate lending, discount interest by poverty alleviation funds, and risk compensation fund by county" are customized for the registered poor people.

Though very small, the water drops finally fill the big container. Through more than five years of development, poverty alleviation microcredit has achieved four results. First, it helps the poor solve the problem of "obtaining loans". In the past, poor households lacked property, collateral and guarantee, and it was difficult to obtain loans even when there were good industrial projects. The adoption of poverty alleviation microcredit policy has removed the loan threshold and reduced the loan cost, which greatly improved the availability and convenience for poverty-stricken households to obtain loans. Second, it achieves the dual effects of developing industry and increasing income. Poverty alleviation microcredit strictly stipulates the purpose of loans. Only for developing industries can poor households obtain preferential loans. This not only supports the poor households to operate industries, but also improves the income of poor households, and is conducive to the development of local industries, forming a cluster development effect. Third, it enhances the internal impetus of the poor. The poverty alleviation microcredit has the financial poverty alleviation fund discount interest. If the poor households do not get loans to engage in the industry, they can't enjoy the policy support. If they take out loans, they are under repayment pressure, which will impel them to take the initiative, stimulate them to work diligently, enhance the self-development ability, and realize the transformation from "I was asked to shake off poverty" to " I want to get rid of poverty" . Fourth, it improves the financial environment in poor areas. For many years, the supply of financial services in poor areas is insufficient and the financial ecological environment is poor. Poverty alleviation microcredit is a kind of credit loan. The credit of poor households is linked with the loan qualification and loan scale. On the basis of the government's credit enhancement, financial institutions actively participate in the poverty alleviation microcredit work and increase the supply of financial services; local governments give full play to the role of rural grassroots organizations, "acquaintance society" and moral restraint, establish positive guidance and correct dishonest behaviors through trustworthy incentives and punishment for the dishonesty, thus greatly improving the financial ecological environment in poverty-stricken areas. Since the implementation of the poverty alleviation microcredit work, many rural households with previous dishonest records have taken the initiative to repay the accumulated debts, or actively resolve neighborhood disputes, or strive to change their bad habits, which improve the credit rating, and improve the social atmosphere and financial environment in poor areas.

- 当代世界出版社

- 扫描二维码,访问我们的微信店铺