【中商原版】精算科学中的预测建模应用 英文原版 Predictive Modeling Applications in Actuarial Science Edward W. Frees

| 运费: | ¥ 0.00-16.00 |

| 库存: | 1 件 |

商品详情

Predictive Modeling Applications in Actuarial Science(Winner, 2018 Kulp-Wright Book Award, American Risk and Insurance Association)(International Series on Actuarial Science)

基本信息

Edited by:Edward W. Frees, Glenn Meyers, Richard A. Derrig

Series:International Series on Actuarial Science

Format:Hardback 330 pages

Publisher:Cambridge University Press

Imprint:Cambridge University Press

ISBN:9781107029880

Published:27 Jul 2016

Weight:748g

Dimensions:257 x 247 x 23 (mm)

页面参数仅供参考,具体以实物为准

书籍简介

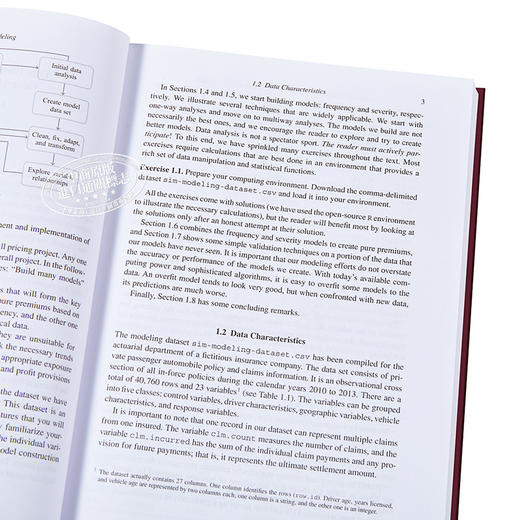

预测模型使用数据来预测未来的事件。它利用解释变量和预测变量之间的关系,从过去的事件,以预测未来的结果。预测金融事件是精算师在保险和其他风险管理应用中例行应用的一项核心技能。精算科学中的预测建模应用强调通过在保险环境中开发工具,提供相关的精算应用,并引入先进的统计技术,可用于在具有复杂数据的情况下获得竞争优势,从而实现终身学习。卷2检查应用的预测建模。第1卷发展了预测模型的基础,第2卷探索了技术的实际应用,关注于财产和意外保险。读者将在具体的、真实的环境中接触到各种技术,这些技术展示了它们的价值和预测建模的总体价值,对于经验丰富的实践分析师和那些刚刚起步的人来说都是如此。

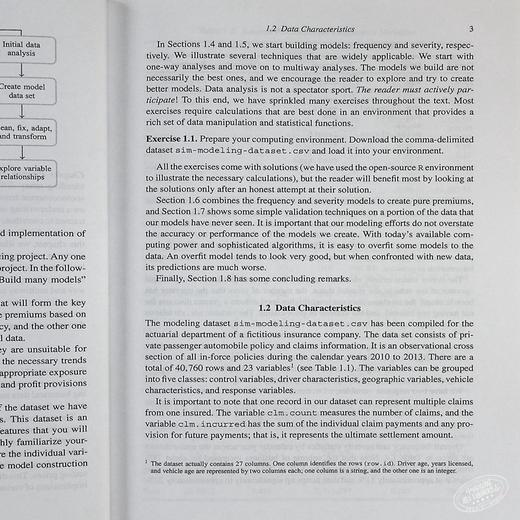

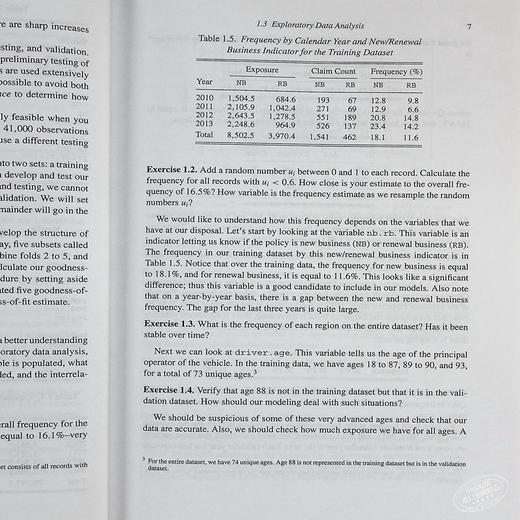

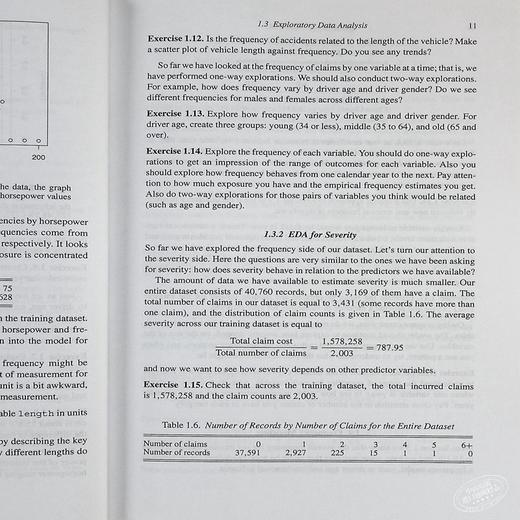

Predictive modeling uses data to forecast future events. It exploits relationships between explanatory variables and the predicted variables from past occurrences to predict future outcomes. Forecasting financial events is a core skill that actuaries routinely apply in insurance and other risk-management applications. Predictive Modeling Applications in Actuarial Science emphasizes life-long learning by developing tools in an insurance context, providing the relevant actuarial applications, and introducing advanced statistical techniques that can be used to gain a competitive advantage in situations with complex data. Volume 2 examines applications of predictive modeling. Where Volume 1 developed the foundations of predictive modeling, Volume 2 explores practical uses for techniques, focusing on property and casualty insurance. Readers are exposed to a variety of techniques in concrete, real-life contexts that demonstrate their value and the overall value of predictive modeling, for seasoned practicing analysts as well as those just starting out.

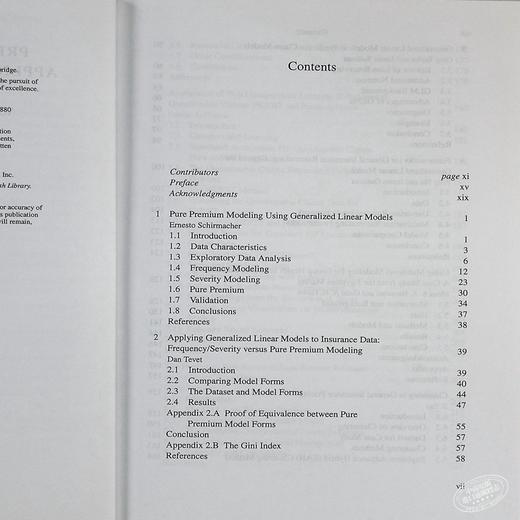

目录

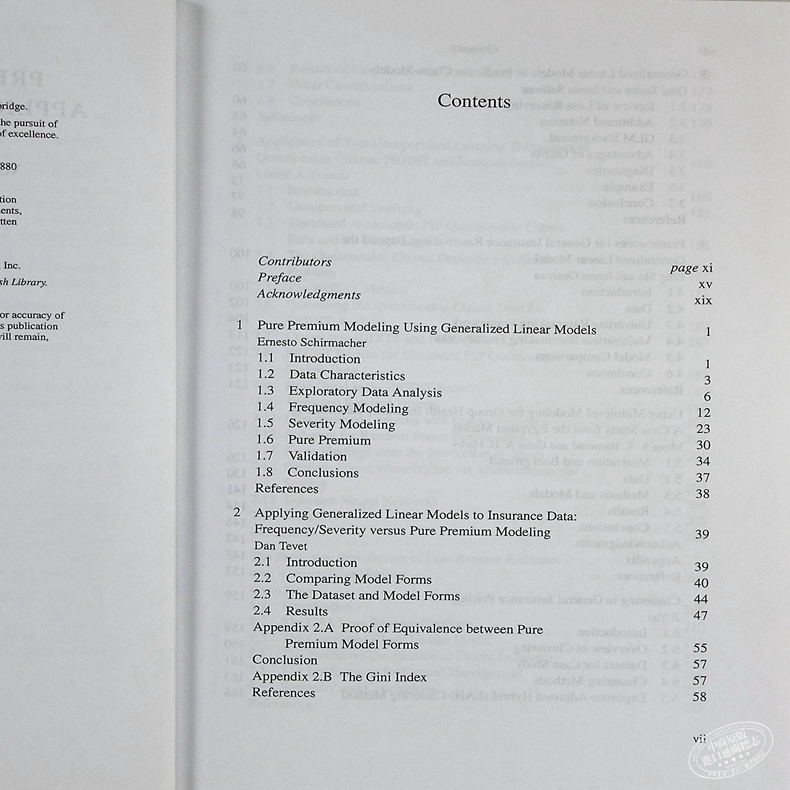

1. Pure premium modeling using generalized linear models Ernesto Schirmacher

2. Applying generalized linear models to insurance data - frequency-severity vs pure premium modeling Dan Tevet

3. GLMs as predictive claim models Greg Taylor and James Sullivan

4. Frameworks for general insurance ratemaking - beyond the generalized linear model Peng Shi and James Guszczaz

5. Using multilevel modeling for group health insurance ratemaking - a case study from the Egyptian market Mona S. A. Hammad and Galal A. H. Harby

6. Clustering in general insurance pricing Ji Yao

7. Advanced unsupervised learning methods applied to insurance claims data Louise A. Francis

8. The predictive distribution of loss reserve estimates over a finite time horizon Glenn Meyers

9. Finite mixture model and workers compensation large loss regression analysis Luyang Fu and Xianfang Liu

10. A framework for managing claim escalation using predictive modeling Mohamad A. Hindawi and Claudine H. Modlin

11. Predictive modeling for usage-based auto insurance Udi Makov and Jim Weiss.

作者简介

Edward W. Frees, University of Wisconsin, Madison

Edward W. (Jed) Frees is the Hickman-Larson Chair of Actuarial Science at the University of Wisconsin, Madison. He received his PhD in Mathematical Statistics in 1983 from the University of North Carolina, Chapel Hill and is a Fellow of both the Society of Actuaries (SoA) and the American Statistical Association (the only Fellow of both organizations). Regarding his research, Professor Frees has won several awards for the quality of his work, including the Halmstad Prize for best paper published in the actuarial literature (four times).

Glenn Meyers, ISO Innovative Analytics, New Jersey

Glenn Meyers, FCAS, MAAA, CERA, and PhD, retired from ISO at the end of 2011 after a 37 year career as an actuary. He holds a BS in Mathematics and Physics from Alma College, Michigan, an MA in Mathematics from Oakland University, Michigan, and a PhD in Mathematics from the State University of New York, Albany. A frequent speaker at Casualty Actuarial Society (CAS) meetings, he has served and continues to serve the CAS and the International Actuarial Association on various research and education committees. He has also served on the CAS Board of Directors. He has several published articles in the Proceedings of the Casualty Actuarial Society, Variance and the Actuarial Review. His research contributions have been recognized by the CAS through his being a three-time winner of the Woodward–Fondiller Prize, a two-time winner of the Dorweiler Prize, the DFA Prize, the Reserves Prize, the Matthew Rodermund Service Award and the Michelbacher Significant Achievement Award. In retirement he still spends some of his time on his continuing passion for actuarial research.

Richard A. Derrig, Temple University, Philadelphia

Richard A. Derrig is founder and principal of OPAL Consulting LLC., a firm that provides research and regulatory support to property casualty insurance clients. Primary areas of expertise include financial pricing models, database and data mining design, fraud detection planning and implementation, and expert testimony for regulation and litigation purposes.

- 中商进口商城 (微信公众号认证)

- 中商进口商城为香港联合出版集团旗下中华商务贸易公司所运营的英美日韩港台原版图书销售平台,旨在向内地读者介绍、普及、引进最新最有价值的国外和港台图书和资讯。

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...