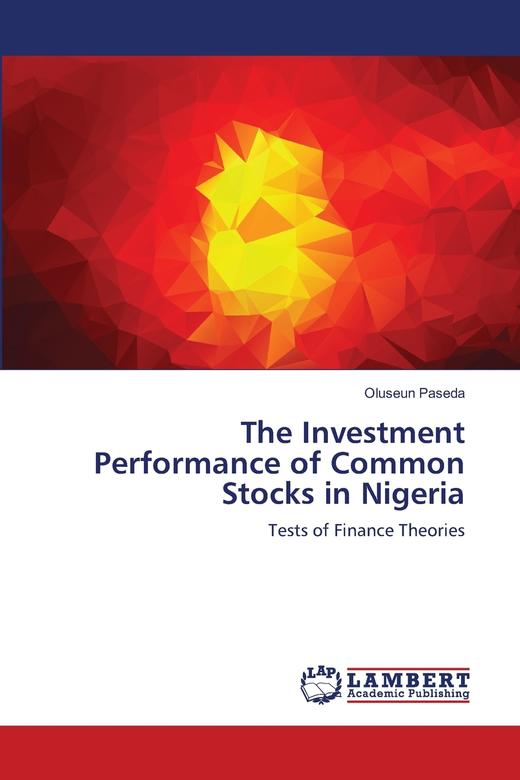

【预售 按需印刷】The Investment Performance of Common Stocks in Nigeria

¥1069.00

| 运费: | ¥ 6.00-25.00 |

商品详情

书名:The Investment Performance of Common Stocks in Nigeria

定价:1069.0

ISBN:9783330001541

作者:Oluseun Paseda

版次:1

出版时间:2016-11

内容提要:

The study considers the investment performance of common stocks (also known as equities) in Nigeria. The underlying finance theories include the Miller-Modigliani (MM) theory, capital asset pricing model (CAPM), the information content of dividends, relationship between common stock returns and systematic factors, the price-earnings ratio and growth potential puzzle and the inflation-hedging capacity of common stocks. The study utilized panel data least squares regression models. The results were mixed with respect to the empirical conformity of the seminal theories. While MM Proposition I holds, the results show weak portability of the MM Proposition II. The CAPM lacks empirical support on the Nigerian Stock Exchange (NSE). The information content of dividends theory has strong empirical support. The study also finds strong support for the interaction between common stocks and macroeconomic factors such as industrial production index, term spread and risk premium. The relationship between price-earnings and growth was weak. Finally, common stocks were found to be effective in hedging against expected inflation but poor hedgers against unexpected inflation.

定价:1069.0

ISBN:9783330001541

作者:Oluseun Paseda

版次:1

出版时间:2016-11

内容提要:

The study considers the investment performance of common stocks (also known as equities) in Nigeria. The underlying finance theories include the Miller-Modigliani (MM) theory, capital asset pricing model (CAPM), the information content of dividends, relationship between common stock returns and systematic factors, the price-earnings ratio and growth potential puzzle and the inflation-hedging capacity of common stocks. The study utilized panel data least squares regression models. The results were mixed with respect to the empirical conformity of the seminal theories. While MM Proposition I holds, the results show weak portability of the MM Proposition II. The CAPM lacks empirical support on the Nigerian Stock Exchange (NSE). The information content of dividends theory has strong empirical support. The study also finds strong support for the interaction between common stocks and macroeconomic factors such as industrial production index, term spread and risk premium. The relationship between price-earnings and growth was weak. Finally, common stocks were found to be effective in hedging against expected inflation but poor hedgers against unexpected inflation.

- 现代书店 (微信公众号认证)

- 中图上海旗下的一家进口图书专营书店。

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...