短线交易秘诀 原书第2版 Long-Term Secrets to Short-Term Trading 英文原版 Larry Williams Wiley

| 运费: | ¥ 0.00-16.00 |

| 库存: | 0 件 |

商品详情

Long-Term Secrets to Short-Term Trading

基本信息

Series:Wiley Trading

Format:Hardback 320 pages

Publisher:John Wiley & Sons Inc

Imprint:John Wiley & Sons Inc

Edition:2nd Edition

ISBN:9780470915738

Published:11 Nov 2011

Classifications:Investment & securities

Readership:Professional & Vocational

Weight:722g

Dimensions:187 x 261 x 25 (mm)

页面参数仅供参考,具体以实物为准

书籍简介

《短线交易秘诀(第2版)》内容简介:1999年,炙手可热的市场大师拉里·威廉斯首次出版《短线交易秘诀》一书时,针对的读者基本上还是专业投资者。过去这些年,发生了很大的变化,现在几乎所有人都在交易,梦想通过成功的短线交易获利,过上更好的生活,也承受着这种选择带来的战栗。

现在,威廉斯带着他全面改版更新的畅销书强势回归,旨在帮助更多新的充满希望的交易者理解市场,并从中赚到盆满钵满。尽管短线交易的风险不小,但回报却全不可知。拉里描绘了成功交易所必须的蓝图,指出了优势也列明了缺陷,让读者也能成为顶尖交易者。

《短线交易秘诀(第2版)》覆盖了从投机与波动率突破,到高概率获利形态等主题,呈现出作者对市场经年的真知灼见。市场是如何运动的,最重要的循环,何时退出交易以及怎样握住成功的交易,威廉斯熟练地解读了交易世界中进场与胜出的一系列基本原理。

Hugely popular market guru updates his popular trading strategy for a post-crisis world

From Larry Williams—one of the most popular and respected technical analysts of the past four decades—Long-Term Secrets to Short-Term Trading, Second Edition provides the blueprint necessary for sound and profitable short-term trading in a post-market meltdown economy. In this updated edition of the evergreen trading book, Williams shares his years of experience as a highly successful short-term trader, while highlighting the advantages and disadvantages of what can be a very fruitful yet potentially dangerous endeavor.

Offers market wisdom on a wide range of topics, including chaos, speculation, volatility breakouts, and profit patterns

Explains fundamentals such as how the market moves, the three most dominant cycles, when to exit a trade, and how to hold on to winners

Includes in-depth analysis of the most effective short-term trading strategies, as well as the author's winning technical indicators

Short-term trading offers tremendous upside. At the same time, the practice is also extremely risky. Minimize your risk and maximize your opportunities for success with Larry Williams's Long-Term Secrets to Short-Term Trading, Second Edition.

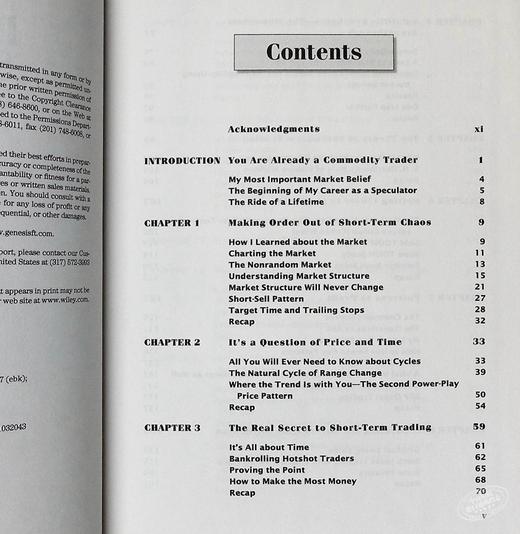

目录

Acknowledgments xi

INTRODUCTION You Are Already a Commodity Trader 1

My Most Important Market Belief 4

The Beginning of My Career as a Speculator 5

The Ride of a Lifetime 8

CHAPTER 1 Making Order Out of Short-Term Chaos 9

How I Learned about the Market 9

Charting the Market 11

The Nonrandom Market 13

Understanding Market Structure 15

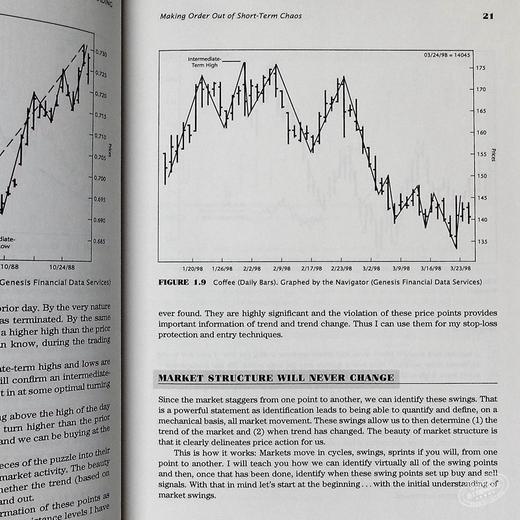

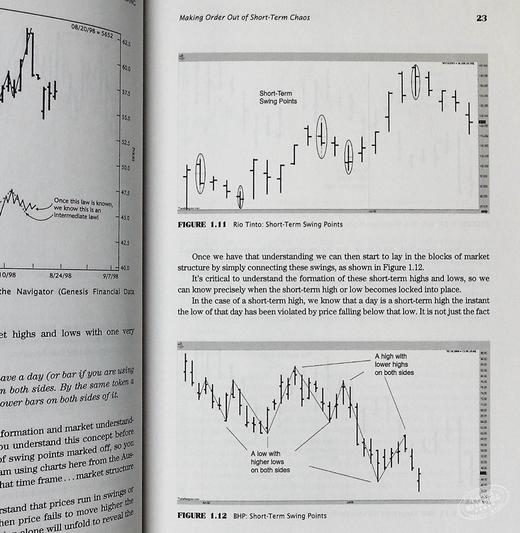

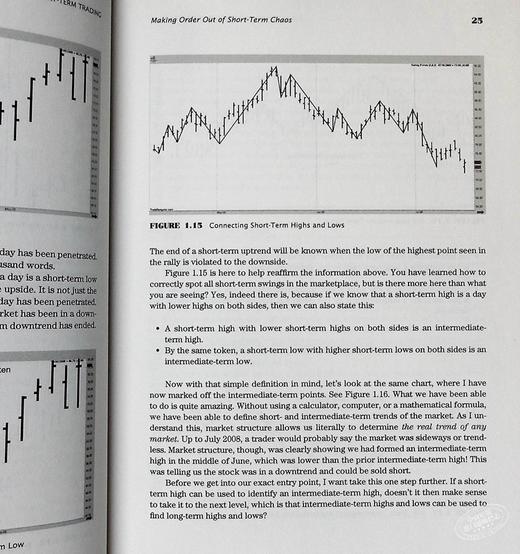

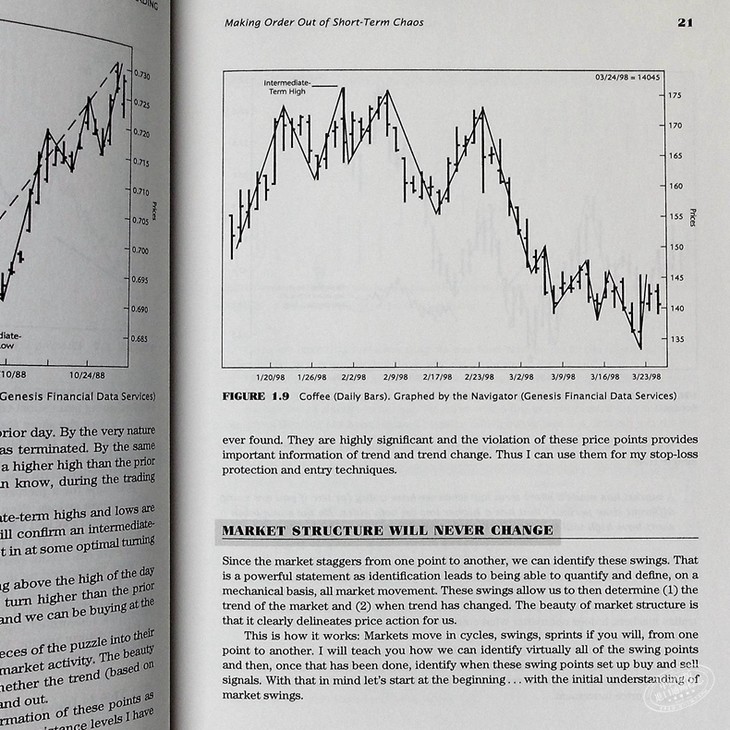

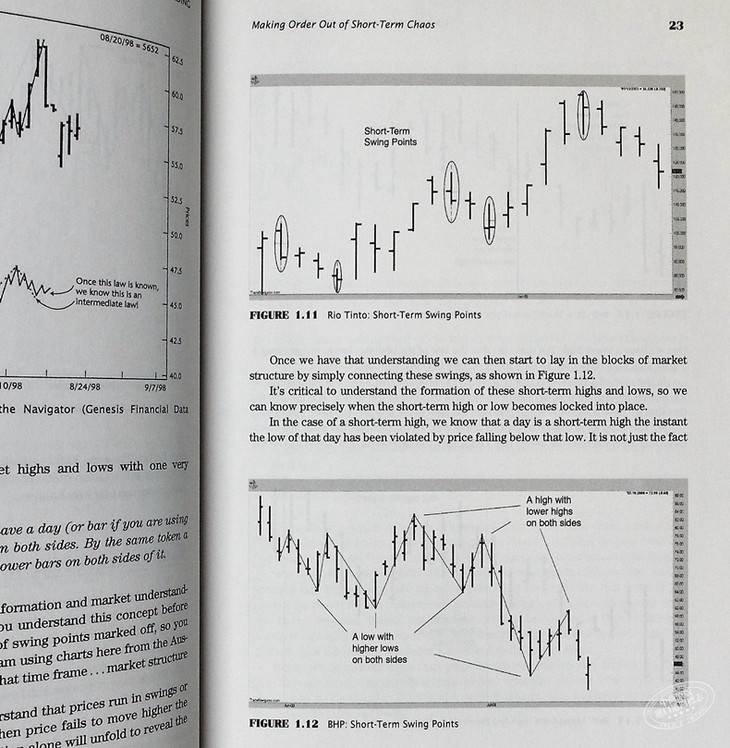

Market Structure Will Never Change 21

Short-Sell Pattern 27

Target Time and Trailing Stops 28

Recap 32

CHAPTER 2 It’s a Question of Price and Time 33

All You Will Ever Need to Know about Cycles 33

The Natural Cycle of Range Change 39

Where the Trend Is with You—The Second Power-Play Price Pattern 50

Recap 54

CHAPTER 3 The Real Secret to Short-Term Trading 59

It’s All about Time 61

Bankrolling Hotshot Traders 62

Proving the Point 65

How to Make the Most Money 68

Recap 70

CHAPTER 4 Volatility Breakouts—The Momentum Breakthrough 71

Simple Daily Range Breakouts 76

A Look at Volatility in the S&P 500 80

Separating Buyers from Sellers to Find Volatility Using Market Swings 95

Results 96

One Step Further 97

Recap 98

CHAPTER 5 The Theory of Short-Term Trading 99

What Is Wrong about the Information Age 103

E. H. Harriman’s Rule of Making Millions 104

Recap 105

CHAPTER 6 Getting Closer to the Truth 107

The Market Is Not a Coin Flip: Random Walk or Cootner versus Cohen (Cohen Wins) 108

Gold TDOM Study 117

Bond TDOM Study 118

Monthly Road Maps 120

Recap 123

CHAPTER 7 Patterns to Profit 125

The Common Element 126

The Questions to Ask 131

My Smash Day Patterns 132

How to Use Smash Day Patterns 136

Specialists’ Trap 137

A Vital Note—This Works on Shorter Time Frames as Well 141

Oops! This Is Not a Mistake 145

S&P Oops! Trading 151

Recap 152

CHAPTER 8 Separating the Buyers from the Sellers 153

Greatest Swing Value 155

Stock Index Trading with Greatest Swing Value 156

Some Pointers 160

Recap 161

CHAPTER 9 Short-Term Trading from a Quote Screen 163

How a Quote-Screen Trader Makes Money 165

Swing Points as Trend Change Indication 166

The Three-Bar High/Low System 167

A New Indicator for Short-Term Traders: Willspread 170

Willspread and the S&P 500 Stock Index 174

Recap 180

CHAPTER 10 Special Short-Term Situations 181

Month-End Trading in Stock Indexes 181

Target Months 184

Making It Better 184

Month-End Trading in the Bond Market 186

Getting Specific 187

Better and Better 188

A Time to Sell 191

Recap 193

CHAPTER 11 When to Get Out of Your Trades 195

CHAPTER 12 Thoughts on the Business of Speculation 197

Exits before Entries 197

What Speculation Is All About 200

It’s about Time 201

Essential Points about Speculation 202

Recap 215

CHAPTER 13 Money Management—The Keys to the Kingdom 217

Most Traders Use a Hit-and-Miss Approach 218

Approaches to Money Management—One Is Right for You 218

The Good, the Bad, and the Ugly of Money Management 219

Looking in New Directions, Drawdown as an Asset 222

Back to Ralph: 2011 Money Management Breakthrough 228

The Kelly Ratio Mirage 229

Recap 233

CHAPTER 14 From Kennedy to Obama, Thoughts from 50 Years of Trading 235

Trading and Collecting Honey 236

Low-Hanging Fruit 237

Look before You Leap 238

Remember the Game Called Pick Up Sticks 238

And It Can Get Worse by Far. . . 239

Lock-Up Time 240

Enough on Greed . . .Now Let’s Deal with Fear 241

Running, Trading, and Losing 242

Doing the Wrong Thing . . . It’s So Easy, Isn’t It? 242

It’s Not the Trade, It’s the Battle 243

The Art of Fly-Fishing Revisited 244

Fear and Greed, Looking Them in the Face Again 245

Why Most Traders Lose Most of the Time 246

A Review of Losing Trades Showed That 247

The Number One Reason We Lose Money Trading 247

The Most Important Trading Belief You Have 248

The Worst Dog I Ever Had Cost Me the Most 249

Athletics Are Such a Parallel to Trading 251

What Causes Stock and Commodity Market Trends 251

How to Measure the Public versus the Pros 253

Folks, It Just Can’t Be Done 254

The Rush of Trading 255

Beating Them to the Punch 257

It’s Just Over My Head 259

I Looked Fear and Greed in the Face 259

The ShowMust Go On 260

Broken Noses, Cauliflower Ears, and Bad Trades 261

Learning How to Lose Money 262

Hillary, High Hopes, and Heartaches 263

Nervous Nellies—Heaven Bound 264

Secrets of System Developing and Trading 265

The Difference between Winners and Losers 266

Recap 268

CHAPTER 15 Just What Does Make the Stock Market Rally? 269

Logic 101 270

These Words Are My Bond 270

A Look at Data A and Data B 270

Let’s Break Some Bad Habits 273

How to Break Bad Habits 273

Comments on Setting Stops—Dollar Loss and Unpredictability 275

An Overview of How I Trade 278

My Trading Strategy . . .How It Works 282

Recap 285

CHAPTER 16 Hard Facts about a Very Hard Game to Win 287

It Is Just Like Life 289

Maybe You Are Not Cut Out for This . . . 292

You Are in a Tough Spot . . . 293

But There’s a Little Bit More. . . 294

In Closing 295

Index 297

作者简介

Larry R. Williams has been trading for almost fifty years and is one of the most highly regarded short-term traders in the world. Larry has taught thousands to trade, won several trading championships, and since 1970 has been writing bestselling books based on his technical indicator, Williams %R, developed in 1966 and still published daily in major financial newspapers and on finance and investing sites. Between trading, researching, and developing trading tools, he ran twice for the U.S. Senate, was a board member of the National Futures Association, and has received numerous awards, including Futures magazine's first Doctor of Futures Award, the Omega Research Lifetime Achievement Award, and Traders International 2005 Trader of the Year. The Mayor of San Diego declared October 6th, 2002 "Larry Williams' Day." Larry has been featured on CNBC and Fox News, and has been interviewed and quoted in more publications than he can keep track of.

- 中商进口商城 (微信公众号认证)

- 中商进口商城中华商务贸易有限公司所运营的英美日韩港台原版图书销售平台,旨在向内地读者介绍、普及、引进最新最有价值的国外和港台图书和资讯。

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...