正版 大空头 英文原版 Big Short 说谎者的扑克牌作者迈克尔刘易斯 奥斯卡同名电影原著小说 英文版进口经济学书籍 Penguin

| 运费: | ¥ 0.00-999.00 |

| 库存: | 16 件 |

商品详情

书名:Big Short 大空头

书名:Big Short 大空头

作者:Michael Lewis

出版社名称:Penguin

出版时间:2011

语种:英文

ISBN:9780141043531

商品尺寸:12.9 x 1.7 x 19.8 cm

包装:平装

页数:288 ★现实版“黑天鹅”,文字版《金钱永不眠》,危机中小人物的惊世传奇

★现实版“黑天鹅”,文字版《金钱永不眠》,危机中小人物的惊世传奇

★贪婪与恐惧,自大与欺诈,金融市场中人性弱点永不缺席

★金融体制存在什么缺陷?投资市场有怎样的道德风险?反思金融体系弊端的绝佳读物

★畅销书《说谎者的扑克牌》作者20年后新力作

万众瞩目的华尔街主导着美国乃至世界经济的风云变幻,提着公文包的商务人士在证券交易所、投资银行、房产信贷机构往来穿梭,光鲜无比。然而这个庞大金融机器中的关键零件早已是锈迹斑斑,一群“小人物”在做空的险途上放手一搏,便有了整个世界经济体系的动荡。是资本主义经济体系已走入困局,还是关于永恒的人性贪婪赌博的又一次胜利?在末日机器的引擎上你会有自己的答案。

THE OUTRAGEOUS NO.1 INTERNATIONAL BESTSELLER, NOW AN OSCAR- AND BAFTA-WINNING FILM

From the jungles of the trading floor to the casinos of Las Vegas, The Big Short, Michael Lewis's No.1 bestseller, tells the story of the misfits, renegades and visionaries who saw that the biggest credit bubble of all time was about to burst, bet against the banking system - and made a killing.

Review

It's time to throw another tank of petrol on the Wall Street pyre, as only Lewis can.

(Financial Times)

He is so good everyone else may as well pack up. (Evening Standard)

No one writes with more narrative panache about money and finance than Mr. Lewis.

(Michiko Kakutani New York Times)

Probably the single best piece of financial journalism ever written (Reuters)

Hugely entertaining (Economist)

Terrifying and superbly told (Daily Telegraph)

Genius(Sunday Times)

Compelling and horrifying(GQ) 20多年前,迈克尔·刘易斯的成名作《说谎者的扑克牌》被公认为描写20世纪80年代华尔街的“教科书”,对美国的金融行业产生了重大的影响。30年后,在华尔街上演了一场席卷全球的2007年金融危机之后,刘易斯照旧洞见烛微,以鞭辟入里、精彩生动的笔触重现危机发生前后华尔街的众生相。

20多年前,迈克尔·刘易斯的成名作《说谎者的扑克牌》被公认为描写20世纪80年代华尔街的“教科书”,对美国的金融行业产生了重大的影响。30年后,在华尔街上演了一场席卷全球的2007年金融危机之后,刘易斯照旧洞见烛微,以鞭辟入里、精彩生动的笔触重现危机发生前后华尔街的众生相。

在迈克尔·刘易斯编著的Big Short《大空头》中,作者充分发挥专业特长,将美国次级抵押贷款债券及其衍生品的起源、发展直至演变为金融危机的过程融入有趣的故事当中,将次贷担保债务权证、夹层担保债务权证、信用违约掉期等产品的操作技巧和手段娓娓道来。同时,作者也全景式地描绘了一个行业和其中形形色色的人物与故事,次贷市场的金融机构、评级机构、投资者等为了自身利益,形成了混乱的交易网,从一个角度揭示了危机的原因和真相。

本书重点刻画了一群智力超群、性格怪异的“终结者”,他们或是名不见经传的华尔街前交易员,或者是非金融专业出身的“门外汉”,却由于对次贷市场的繁荣和金融衍生工具的层出不穷充满质疑和不信任,终于洞察到美联储、美国财政部及华尔街的“金融大鳄”都不曾察觉的市场泡沫,从而将赌注押在美国金融市场行将崩溃上。危机爆发了,他们打败了华尔街。

在这个情节跌宕起伏的故事背后,有更多的东西值得我们深思。投行如何用风险的复杂化掩盖产品的风险?评级制度存在怎样的盲点?金融界怎样运用术语编造谎言来欺骗客户?人性的缺陷和金融体系的弊端在本书中皆可窥见一斑。 迈克尔·刘易斯(Michael Lewis),美国畅销书作家,毕业于美国普林斯顿大学和英国伦敦经济学院,曾任所罗门兄弟公司的交易员,后为《纽约时报》撰稿,并担任英国《观察家周刊》的美国版编辑。他的成名作《说谎者的扑克牌》被公认是描写20世纪80年代华尔街文化的经典名作,书中的精彩片段被各种媒体广泛引用,对美国商业文化产生了重大影响,还著有《钱球》、《盲边》以及《住房游戏》。

迈克尔·刘易斯(Michael Lewis),美国畅销书作家,毕业于美国普林斯顿大学和英国伦敦经济学院,曾任所罗门兄弟公司的交易员,后为《纽约时报》撰稿,并担任英国《观察家周刊》的美国版编辑。他的成名作《说谎者的扑克牌》被公认是描写20世纪80年代华尔街文化的经典名作,书中的精彩片段被各种媒体广泛引用,对美国商业文化产生了重大影响,还著有《钱球》、《盲边》以及《住房游戏》。

Michael Lewis was born in New Orleans and educated at Princeton University and the London School of Economics. He has written several books including the New York Times bestseller, Liar's Poker, widely considered the book that defined Wall Street during the 1980s. Lewis is contributing writer for the New York Times Magazine and for Vanity Fair. He is married with three children. Chapter 1 A Secret Origin Story

Chapter 1 A Secret Origin Story

Chapter 2 In the Land of the Blind

Chapter 3 “How Can a Guy Who Can’t Speak English Lie?”

Chapter 4 How to Harvest a Migrant Worker

Chapter 5 Accidental Capitalists

Chapter 6 Spider-Man at The Venetian

Chapter 7 The Great Treasure Hunt

Chapter 8 The Long Quiet

Chapter 9 A Death of Interest

Chapter 10 Two Men in a Boat Eisman entered finance about the time I exited it. He’d grown up in New York City, gone to yeshiva schools, graduated from the University of Pennsylvania magna cum laude, and then with honors from Harvard Law School. In 1991 he was a thirty-year-old corporate lawyer wondering why he ever thought he’d enjoy being a lawyer. I hated it,” he says. I hated being a lawyer. My parents worked as brokers at Oppenheimer securities. They managed to finagle me a job. It’s not pretty but that’s what happened.”

Eisman entered finance about the time I exited it. He’d grown up in New York City, gone to yeshiva schools, graduated from the University of Pennsylvania magna cum laude, and then with honors from Harvard Law School. In 1991 he was a thirty-year-old corporate lawyer wondering why he ever thought he’d enjoy being a lawyer. I hated it,” he says. I hated being a lawyer. My parents worked as brokers at Oppenheimer securities. They managed to finagle me a job. It’s not pretty but that’s what happened.”

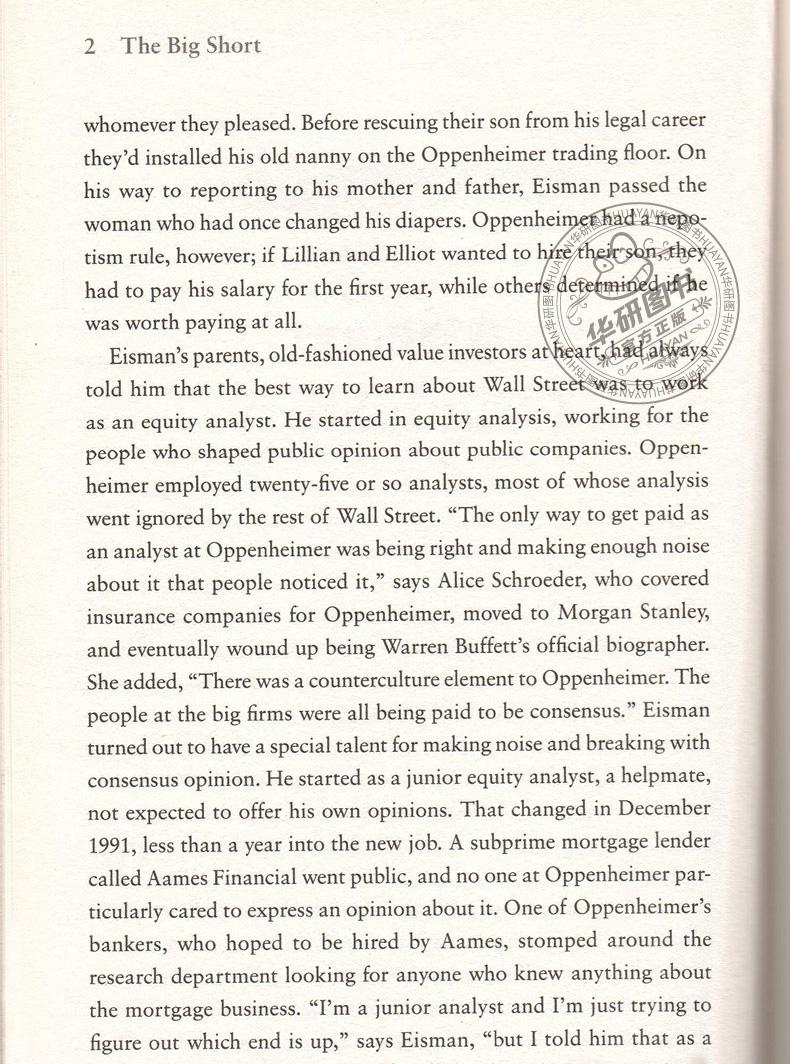

Oppenheimer was among the last of the old-fashioned Wall Street partnerships and survived on the scraps left behind by Goldman Sachs and Morgan Stanley. It felt less like a corporation than a family business. Lillian and Elliot Eisman had been giving financial advice to individual investors on behalf of Oppenheimer since the early 1960s. (Lillian had created their brokerage business inside of Oppenheimer, and Elliot, who had started out as a criminal attorney, had joined her after being spooked once too often by midlevel Mafia clients.) Beloved and respected by colleagues and clients alike, they could hire whomever they pleased. Before rescuing their son from his legal career they’d installed his old nanny on the Oppenheimer trading floor. On his way to reporting to his mother and father, Eisman passed the woman who had once changed his diapers. Oppenheimer had a nepotism rule, however; if Lillian and Elliot wanted to hire their son, they had to pay his salary for the first year, while others determined if he was worth paying at all.

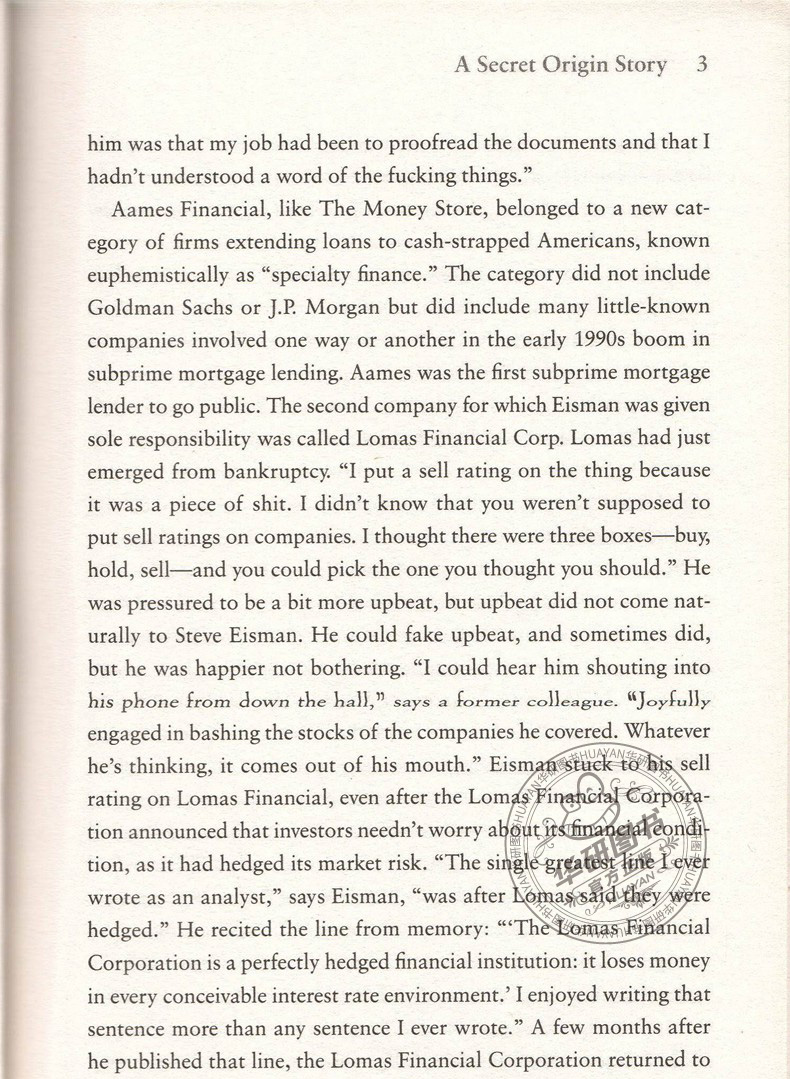

Eisman’s parents, old-fashioned value investors at heart, had always told him that the best way to learn about Wall Street was to work as an equity analyst. He started in equity analysis, working for the people who shaped public opinion about public companies. Oppenheimer employed twenty-five or so analysts, most of whose analysis went ignored by the rest of Wall Street. “The only way to get paid as an analyst at Oppenheimer was being right and making enough noise about it that people noticed it,” says Alice Schroeder, who covered insurance companies for Oppenheimer, moved to Morgan Stanley, and eventually wound up being Warren Buffett’s official biographer. She added, there was a counterculture element to Oppenheimer. The people at the big firms were all being paid to be consensus.” Eisman turned out to have a special talent for making noise and breaking with consensus opinion. He started as a junior equity analyst, a helpmate, not expected to offer his own opinions.

- 华研外语 (微信公众号认证)

- 本店是“华研外语”品牌商自营店,全国所有“华研外语”、“华研教育”品牌图书都是我司出版发行的,本店为华研官方源头出货,所有图书均为正规正版,拥有实惠与正版的保障!!!

- 扫描二维码,访问我们的微信店铺

- 随时随地的购物、客服咨询、查询订单和物流...